Since its inception in 2009, the cryptocurrency market has grown exponentially, amassing a total value of $800 billion by year’s end. However, crypto investing requires meticulous understanding to ensure safety and security.

New investors can potentially face risks such as human errors, hacking, or scams if they leap without understanding the nuances of the market. Unlike traditional stock market investments, crypto transactions occur digitally on a decentralized blockchain. This absence of third-party institutions such as banks further necessitates investor awareness.

If you’re ready to dive into crypto investing, this article and our website offer extensive research on investing strategies, digital asset storage options, and general cryptocurrency insights. Make sure to visit regularly for updates.

Table of Contents

- How to Invest in Cryptocurrency

- What Are the Best Crypto to Invest in 2023?

- Top Security Actions for Investing in Cryptocurrencies

- What’s the Best Crypto Wallet?

- Alternative Ways to Invest in Crypto

- What Is Crypto?

- Get a Crypto Wallet

- How to Choose an Online Broker or Crypto Trading Service

- General Crypto Trading Tips

- How to Buy Cryptocurrency Guides

- Cryptocurrency Price Prediction Guides

- Best Staking Crypto Guides

- Bottom Line

How to Invest in Cryptocurrency

eToro is a widely respected and regulated broker that provides a wide array of services to traders of all levels of experience. With eToro, signing up for an account is not only straightforward but also fast, allowing investors to start trading right away.

The comprehensive selection of crypto assets available on the platform makes it easy for traders to find the investment opportunity they are looking for. This guide will provide step-by-step instructions on how to create an eToro account and invest in crypto with ease. With this comprehensive guide, traders can set up their accounts quickly and start investing in cryptos without any hassle.

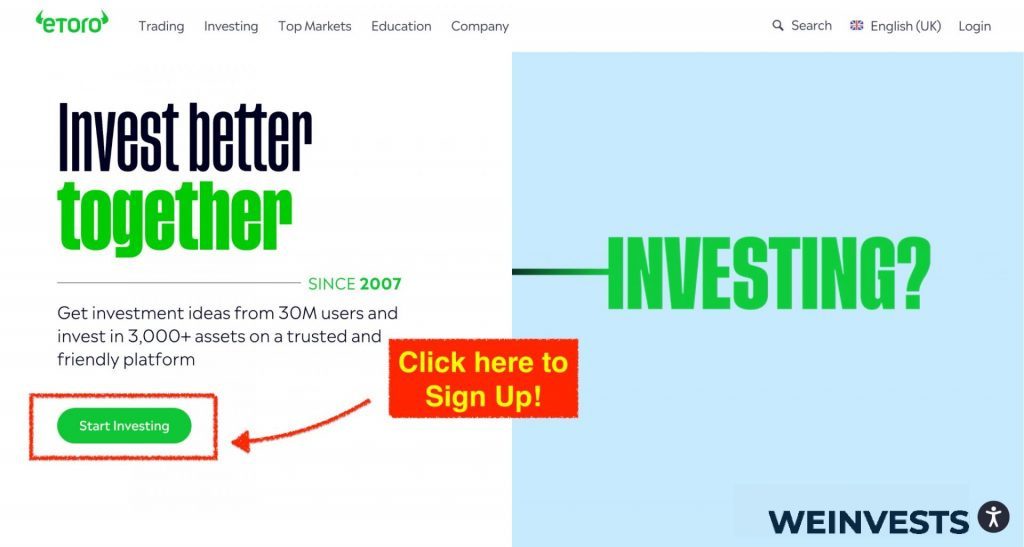

Step 1: Open an Account

Creating an account with eToro is a straightforward process that can easily be accomplished in just a few steps.

To begin, navigate to the company’s website. From here, you’ll be able to locate and press the “Sign Up” or “Join Now” button located on the homepage, which will take you to the registration page. After inputting your name, email address, phone number, and password, just click “Start Investing” and “Create Account” to finalize the process. For reference, an image of the homepage is included below.

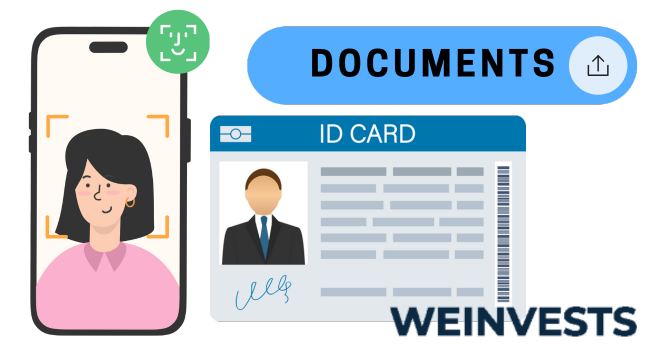

Step 2: Upload ID

In order to comply with financial regulations and maintain security, eToro requires users to verify their identity. To do this, users must upload a clear image or scanned copy of a government-issued identification card or passport. All details on the document should be easily recognizable so that verification can occur swiftly.

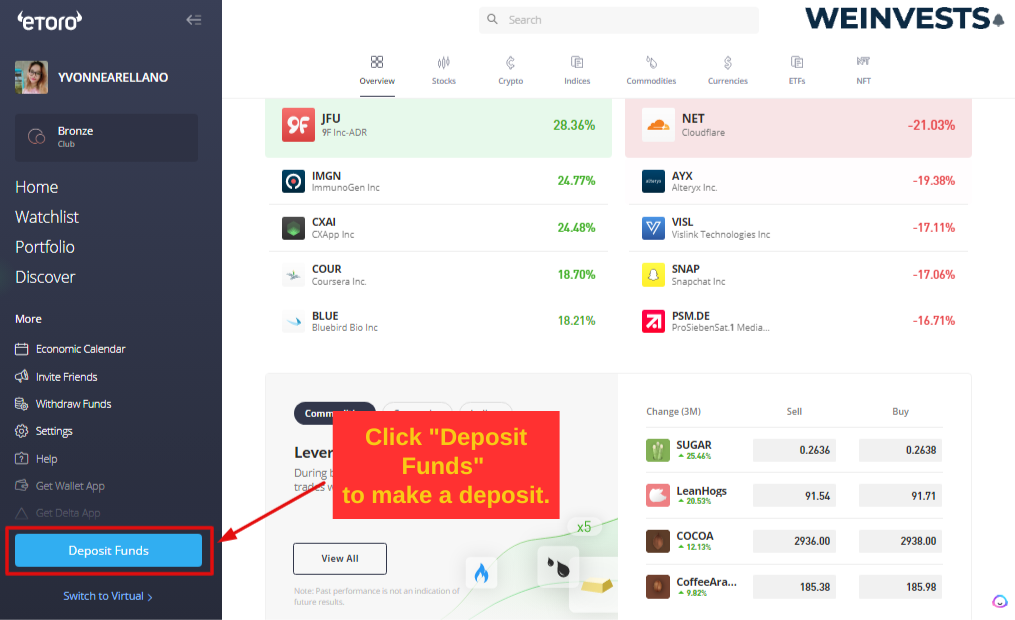

Step 3: Make a Deposit

If you’re looking to begin investing in cryptocurrency, the first step is to deposit funds into your eToro account. To do this, log in to the platform and select the ‘Deposit Funds’ button located at the bottom left corner of the page. You can then fund your account with a range of payment methods, such as bank transfers, credit/debit cards, or e-wallets like PayPal, Skrill, or Neteller.

Please note that the minimum deposit amount may vary depending on your region and chosen payment method. We have added a screenshot of the platform with an arrow pointing to the ‘Deposit Funds’ button for your convenience.

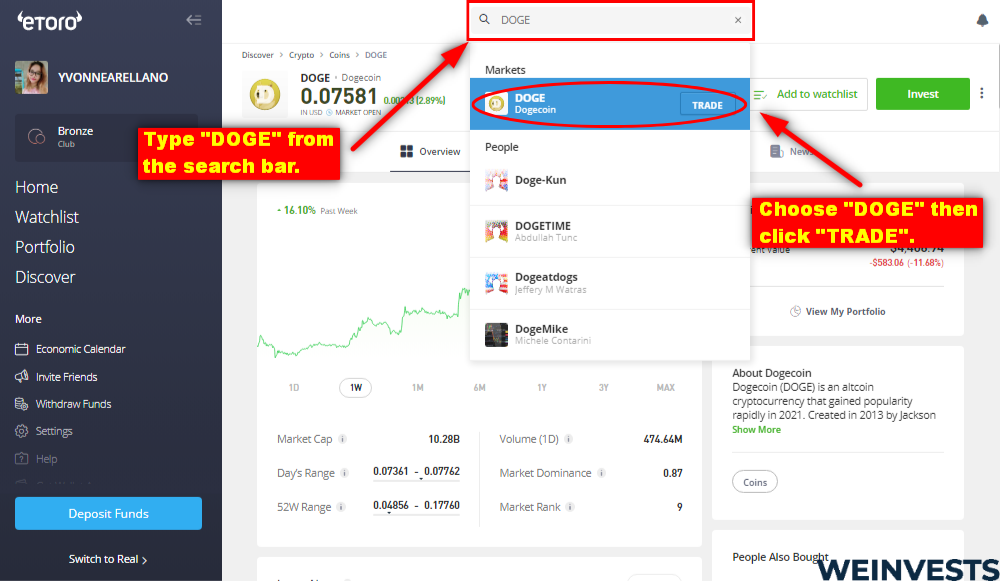

Step 4: Search For A Crypto Asset

eToro provides investors with a comprehensive platform to research and invest in different crypto assets. Investors can explore a list of cryptos which is categorized for easy navigation and comparison; each entry includes detailed, in-depth data to assist with analysis. This makes it easy for traders to make informed decisions on the best crypto investment opportunities. Not only that, but users can easily find the crypto they wish to invest in using eToro’s intuitive interface. All of these features come together to help investors make smart decisions about where to put their money.

Step 5: Trade The Crypto Asset

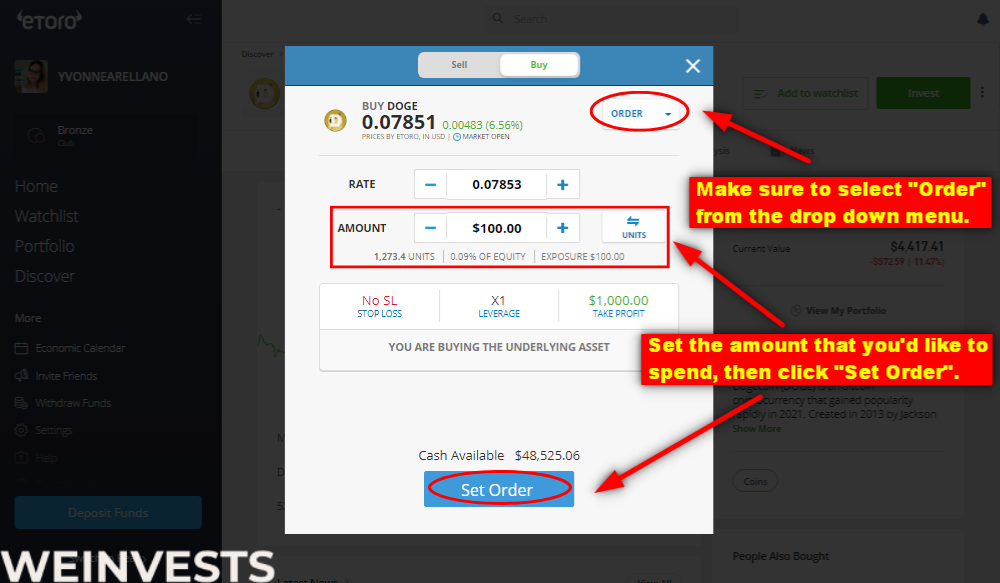

Investing in cryptocurrencies is a simple and straightforward process. To get started, users need to look for the crypto they are interested in on their chosen online trading platform. Once located, they should click on it to open its detailed page, which will provide essential information regarding the company, such as current market price, market capitalization, and the latest news.

To invest in the crypto, users must click on the “Trade” button to open a new window where they can enter the amount of money they wish to put into it and any other order parameters that may be applicable. When ready, simply hit “Open Trade” to complete the investment process.

What Are the Best Crypto to Invest in 2023?

Choosing the best cryptocurrency to invest in for 2023 is a personal decision. This is especially true considering the broader cryptocurrency market experienced what’s known as “crypto winter” when crypto prices were in the doldrums.

However, that doesn’t mean there aren’t any opportunities around the corner that you might want to consider. Below is a list of a few suggestions comprising some of the cryptocurrencies that have proven to be winners in the past:

1. Bitcoin

Bitcoin is the first cryptocurrency and it is the most popular one, with a market capitalization of $322 billion as of year-end. Bitcoin is the most widely accepted cryptocurrency as a payment method, and therefore demand for this cryptocurrency is likely to persist in 2023. If you are new to crypto investing, you might want to start out by owning bitcoin, which has the longest trading history and has proven to be resilient throughout bull and bear market cycles.

2. Ethereum

Ethereum is the second-biggest cryptocurrency and with a market cap of $147 billion as of year-end, it is also very popular among investors. Ethereum is known for its versatility and is the most popular cryptocurrency for use in market niches like decentralized finance (DeFi), such as staking and yield farming, or non-fungible tokens (NFTs). If you plan to participate in the DeFi market or own an NFT, you might want to consider adding Ethereum to your portfolio. It is not the only crypto that can be used for these activities but given its market dominance it is a good place to start.

3. Dogecoin

Dogecoin is one of the most popular cryptocurrencies and ranks among the top 10. Dogecoin was the market’s first “meme coin” which means it basically trades on social media sentiment rather than any fundamentals of the coin. Its mascot is a Shiba Inu, a Japanese breed dog. Dogecoin is famous for being among the few cryptocurrencies that billionaire Elon Musk owns. Now that Musk owns Twitter, the Dogecoin community is hopeful that he will somehow integrate Dogecoin payments onto the social media platform. So far this has not happened but if it does, it could bode well for Dogecoin demand and price in 2023.

Before you invest – You need to do your due diligence

Before you invest in these or any cryptocurrencies, it’s important to understand one of the common features they all share and that is volatility. It is not uncommon for prices to swing violently from one extreme to another in a short period of time. Therefore you should be prepared for these market movements before you invest.

Also, cryptocurrencies are still an emerging asset class. They only have a little over a decade of trading history behind them compared to stocks, which have been around for hundreds of years. This means that cryptocurrency prices can be hard to predict. Even the earliest and most experienced crypto investors have gotten it wrong before.

However, the market predictions are becoming more common as Wall Street analysts have decided this asset class is too big to ignore. Firms have begun issuing their own research and price predictions on leading cryptos.

Top Security Actions for Investing in Cryptocurrencies

Cryptocurrency has become a popular form of investment in recent years, and with its rise in popularity, it is important to understand the security measures that should be taken when investing. Cryptocurrency transactions are secure by design, but there are still risks associated with investing in digital assets. Here are five of the top security actions for investing in cryptocurrency:

- Research: Before investing in any cryptocurrency, it is important to do your research. Make sure you understand the technology behind the cryptocurrency and how it works. Also, research the exchange or platform you plan to use to buy and sell your cryptocurrency. Check for legitimate trade volumes and a strong reputation for security.

- Use a Secure Wallet: A secure wallet is essential for storing your cryptocurrency safely and securely. There are many different types of wallets available, such as hardware wallets, software wallets, and paper wallets. Choose one that best suits your needs, and make sure you keep it safe from hackers or other malicious actors who may try to steal your funds.

- Monitor Your Accounts Regularly: It’s important to regularly monitor all of your accounts related to cryptocurrencies – including exchanges, wallets, etc. – for any suspicious activity or unauthorized transactions. If anything looks out of place, take action immediately by contacting customer service or changing passwords if necessary.

- Diversify Your Portfolio: As with any type of investment portfolio, diversifying is key when investing in cryptocurrencies as well. Don’t put all of your eggs in one basket; spread out investments across multiple coins so that if one coin takes a hit, others may not suffer as much damage from it.

- Learn to Recognize Scams: a popular scam operation such as a “Honey pot” that lures investors with the promise of huge returns can be extremely dangerous. Learn to recognize these types of scams and never give away your personal information or money to anyone you do not trust completely. For instance, do not trust a newly born cryptocurrency with no information or bad feedback. An audited smart contract that’s been reviewed by independent security experts is a must-have for any legitimate cryptocurrency.

By following these five steps when investing in cryptocurrency, investors can ensure their investments are more secure than ever before while still reaping the rewards that come with owning digital assets like Bitcoin and Ethereum.

What’s the Best Crypto Wallet?

As discussed, your crypto wallet is where you will store your crypto. It is also the place from which you will send your crypto from one place or person to another. The beauty of crypto wallets is that they support cryptocurrencies of all kinds, including bitcoin and the many altcoins that are out there. Just be sure and find one that supports the cryptocurrencies you are interested in owning.

The best crypto wallet is the one that meets your needs, whether it’s desktop, web/exchange, mobile, paper, or hardware. Many of the online digital wallets are available for free, such as MetaMask, so all you need to do is pick your favorite one and create an online account. We have gathered a list of some of the most popular cryptocurrency wallets and why:

- MetaMask: Its interface is easy to navigate and provides access not only to Ethereum but also the thousands of cryptocurrencies that are based on the Ethereum token standard. Fees are something you’ll want to watch and tend to get high.

- Coinbase: Coinbase supports thousands of cryptocurrencies that are widely traded. The Coinbase wallet has the backing of the Coinbase exchange, the most popular U.S. based crypto trading platform.

- Crypto.com: You can negotiate the fee and have access to hundreds of cryptocurrencies. Keep in mind you are responsible for storing your own private key and seed phrase.

- Trust Wallet: The Trust Wallet supports a variety of cryptocurrencies and gives users the opportunity to generate interest on their holdings. It is also convenient to use for trading NFTs and interacting with decentralized apps (Dapps) on the blockchain.

- Ledger: This is a popular crypto hardware wallet. Ledger has an app that lets users buy and sell crypto directly and provides two-step transaction confirmations. It supports a wide variety of cryptos and has a reputation for being secure.

Alternative Ways to Invest in Crypto

Cryptocurrency investing is becoming increasingly popular as more and more people are looking to diversify their portfolios. While buying and selling cryptocurrencies directly in the spot market is one of the most common ways to invest, there are several other methods that can be used to gain exposure to the crypto markets.

Keep in mind that the methods we will mention won’t involve any actual direct investment in crypto, with a few advantages:

- You won’t need to worry about storing the crypto securely, as you would if you bought it directly.

- You can hedge against market moves by taking a long or short position, depending on your outlook.

- You won’t need to deal with gas fees, as the methods we’ll mention don’t involve any blockchain transactions.

One of these alternative methods is through financial derivatives such as Contracts for Difference (CFDs) or futures contracts. CFDs allow investors to speculate on the price movements of a cryptocurrency without actually owning it, while futures contracts enable investors to buy or sell an asset at a predetermined price at a future date. Both of these instruments provide investors with an opportunity to capitalize on short-term price movements without having to purchase and hold the underlying asset.

Before buying a CFD, you should know how the contract’s fees work: there is usually a spread between the buy and sell price quoted on your trading platform. This spread, as well as any commissions and other fees, will be taken out of your profits when you close out your position.

Furthermore, it is highly likely that a daily or weekly funding fee will be charged for holding an open position. This can significantly reduce your profits if the markets move against you.

Another way to invest in crypto is through investment products such as exchange-traded funds (ETFs). ETFs are baskets of assets that track the performance of an underlying index, commodity, or security. After a few legal battles, crypto ETFs are now beginning to appear on the market, enabling investors to gain exposure to the crypto markets without having to purchase and store cryptocurrencies.

Futures are also becoming increasingly popular. These allow investors to take a long or short position in the underlying asset without actually owning it. Investors can use futures to hedge against market moves or speculate on price movements, depending on their outlook.

Within this family, a special mention needs to be made for perpetual futures. Unlike traditional futures, perpetual futures do not expire and can be held open indefinitely. This means that investors can take advantage of the volatility of crypto markets for as long as they want to stay in the market.

No matter which method you choose, it’s important that you do your own research before investing in any cryptocurrency-related product or service. Make sure you understand how each instrument works and what risks are involved before making any decisions about investing your money.

Investing in derivatives is always riskier than investing in the underlying asset, as the investment leverage can lead to larger losses as well as gains. Therefore, it’s important that you remain vigilant and take steps to protect your capital. As always, do not invest more than you are willing to lose.

What Is Crypto?

Before investing in cryptocurrencies, it helps to have a grasp on what they are. Cryptocurrencies are digital currencies that are based on cryptography, a mathematical strategy used to protect data and communicate in code. They are not issued by any central bank and instead are built to transact on the blockchain, a decentralized online ledger where transactions are recorded.

Cryptos are decentralized in nature, which means they are transferred on a peer-to-peer (P2P) network, without the need for a third-party intermediary like a bank. Quite simply, cryptocurrencies are digital forms of money that can be used as a medium of exchange.

Bitcoin was the first cryptocurrency created and it remains the biggest and most widely accepted crypto in the world today. It has two primary use cases: as a medium of exchange, aka money, or as a store of value, like gold. In fact, bitcoin has earned the nickname “digital gold”.

The rise of bitcoin has inspired thousands of other digital assets that have been created in its wake. In general, these cryptos have come to be known as altcoins. Altcoins are widely available on many cryptocurrency exchanges or trading platforms and can be stored on any number of digital wallets.

These altcoins jockey for position in the cryptocurrency rankings. Some go out of style while others grow in popularity over time. Bitcoin has never lost its position as the top-ranked cryptocurrency in the No. 1 spot, while Ethereum has managed to hold onto the No. 2 ranking.

Get a Crypto Wallet

One of the first steps to crypto investing is to get yourself a cryptocurrency wallet. This is a digital wallet that you will use to buy, sell, send and receive cryptocurrencies. You should decide on a crypto wallet before you even sign up for an exchange so that you are prepared to move your assets to your wallet if you so desire. It will also come into play depending on whether you choose a centralized or decentralized crypto exchange.

A crypto wallet is similar to a bank account but it’s not exactly the same. There are no physical assets to store in it. Instead, we are talking about a software program on which your public and private keys are stored. Depending on the type of wallet, the software program could be tied to a piece of hardware, like a USB device. Your cryptocurrency holdings will be stored on the blockchain.

Crypto wallets can be divided into two primary categories: custodial or non-custodial. A custodial wallet is one that is controlled by a centralized party, like a crypto exchange. The custodian controls the public and private keys that unlock your crypto. A non-custodial wallet is one in which the investor controls the keys and therefore is responsible for keeping the seed-phrase safe to unlock their assets.

Next crypto wallets can be further broken down into the following categories:

- Hot Wallet: This is a crypto wallet that is connected to the internet. Hot wallets are considered simple to use and convenient. However, since they are online, hot wallets are vulnerable to being hacked by bad actors. So the pros advise not storing large amounts of crypto in a hot wallet.

- Cold Wallet: This type of wallet is not connected to the internet. Instead, these are hardware devices that require some technical knowledge to master. Cold wallets are considered more secure than their hot-wallet counterparts since they are not online. Cold wallets are recommended when you’ve got lots of crypto to store.

Hot wallets can further be broken down into the following categories:

- Desktop: A desktop wallet relies on encryption to protect an investor’s private keys, which are used to unlock the crypto and stored on your PC’s hard drive.

- Web: This is a popular type of wallet that is offered by cryptocurrency exchanges, such as Coinbase or Binance, for example. They allow an investor to access their crypto holdings from their web browser on the exchange’s website. By using a web wallet, you are trusting a third party, in this case an exchange, to keep your crypto funds safe.

- Mobile: A mobile wallet allows an investor to store or spend their crypto holding straight from their mobile device. All you need is a mobile phone and access to the internet.

Cold wallets can further be broken down into the following categories:

- Paper: This is a wallet that is not connected to the internet. It is an offline wallet that requires users to use private keys to access their crypto. These private keys come in the form of a seed phrase, which is a series of words that unlock access to the owner’s funds stored in the wallet. The seed phrase should not be shared with anyone. It can be kept safe by writing the words down in a journal of some sort and stored somewhere private. Some people choose to memorize the seed phrase. While paper wallets are safe from hackers, you run the risk of losing or forgetting your private keys, in which case there is no recourse to access your holdings.

- Hardware: A hardware wallet is a physical item akin to a USB device that remains unconnected from the internet until you insert it into your computer or mobile device. Hardware wallets are largely considered secure and rely on a user’s private key to transact on the blockchain. Hardware wallets can be tricky for newbies to master.

How to Choose an Online Broker or Crypto Trading Service

When it comes to choosing an online broker or crypto trading service, there’s no shortage of options. Here are some general rules of thumb:

- Find one with several years of operating history behind it and that supports the most popular cryptocurrencies.

- Find an exchange whose trading volumes in the coins you want to buy are high. High volumes suggest there will be enough liquidity to buy and sell the crypto at any given time.

- Be sure and do your own research (DYOR) on the cryptos you are interested in owning.

- Also DYOR on commissions or trading fees charged by the trading platforms you are considering using. Exchanges charge transaction fees on buy and sell trades to make money. Unless you are making mega-sized trades, there is no escape from these fees.

Excellent choice of cryptocurrency exchanges and brokers:

- eToro: A social trading platform that lets novices copy the trading strategies of more sophisticated traders.

Get a Crypto Exchange Account

When you are ready to open an account on a cryptocurrency exchange, you are one step away from being able to buy, sell, and hold cryptocurrencies. You will be able to purchase your crypto on the exchange and send it to your wallet if you would like to.

All you will need is the specific wallet address attached to that specific coin. Each coin possesses its own unique wallet address and it is important to send it to the right one. Otherwise the funds will be lost.

Here are the steps to getting a crypto exchange account:

- Choose the platform on which you would like to invest, whether it’s eToro, Coinbase, or something else. Be sure that the exchange is available for investors in your region. Not all exchanges operate in every jurisdiction.

- Prepare to enter some personal details and verify your identity on the exchange. This will involve uploading some documents, such as a driver’s license, Social Security number, selfie, or passport, for example. Proper exchanges are required by laws such as know-your-customer (KYC) to verify a user’s identity. In some cases, account verification can take a couple of days.

- Enable two-factor authentication. This is a security measure that will help to prevent your account from hackers. Generally this is in addition to a password. It involves connecting your mobile phone to your account so the exchange can send a code when you want to log in.

- Once you’ve created an account on a cryptocurrency exchange, the next step is to fund your account so that you can begin investing. To do this, you must choose a payment option supported by the trading platform. This could be anything from a bank account to a debit/credit card to a payment platform like PayPal. Once you’ve selected your payment option, you enter the amount you would like to fund and submit your payment.

- Next search for the cryptocurrency you would like to invest in and follow the prompts to buy.

If you are using a decentralized exchange (DEX) such as Uniswap, for example, you will have to connect your existing crypto wallet to the trading platform via an extension. DEXs are non-custodial in nature and do not have wallets to store your crypto for you. They run on products known as smart contracts on the blockchain, which allow users to trade directly without any centralized entity involved.

In lieu of your personal details, DEXs require you to have your own crypto wallet to participate. They will prompt users to connect to an outside wallet, like MetaMask, for example. Choose the appropriate wallet and select “connect.” You may have to enter the password tied to your online wallet to continue.

General Crypto Trading Tips

Now that you know what you will need to invest in crypto, the next step is to become proficient at trading so that you can optimize your potential returns efficiently. The only way to improve your investing skills is to continue learning.

Trading platforms like eToro let you learn from experienced traders and even copy their investment portfolio and strategies. This is one way to become a better crypto trader. Here are some more rules of thumb:

- Don’t invest more than you can afford to lose

- Use a trusted cryptocurrency exchange in your region.

- Past performance is not a guarantee of future returns. Just because a coin generated profits for investors before doesn’t mean it will continue to do so in the future. Know the risks.

- Understand that crypto moves in cycles and the market downturns can sometimes last for a while. Bitcoin and other leading cryptocurrencies including Ethereum, among others, have proven to be resilient through these market cycles.

Something that the best crypto traders have in common is that they have been doing it for a while. It is important to gauge your expectations so that you don’t presume you will be an overnight success. Successful trading takes time in any market, and crypto is no exception. Once you begin trading, analyze your results and try to learn from your own mistakes so you can avoid them in the future.

How to Buy Cryptocurrency Guides

Cryptocurrency Price Prediction Guides

Best Staking Crypto Guides

Bottom Line

You have probably learned by now that there are many hoops to jump through with cryptocurrency investing. However, it is not as daunting now that you understand the fundamentals of crypto investing. If you continue to learn and follow the advice of those who have gone before you, it won’t be long before you are investing in crypto like a pro.

For more information on the cryptocurrency landscape, including the assets as well as strategies like decentralized finance (DeFi) and non-fungible tokens, explore our site and read more of the content that we have available for you. The crypto market is constantly evolving and growing. Fortunately, there is no shortage of thoroughly researched topics covered, so don’t hesitate to continue learning right here.