This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

There are countless choices available when it comes to cryptocurrencies, and those choices are continually expanding.

What’s more, new digital coins are released on a regular basis, each of which has something different and interesting to offer to potential users. However, with so many options available, it can be challenging to know where to begin.

Earning passive income from your digital currency is one such option, referred to as staking.

Ankr (ANKR) uses a consensus mechanism, Proof-of-stake (PoS), that allows you to earn rewards just by holding ANKR.

Here, we will look at what ANKR staking is and how it functions.

Pros

- You don’t need a deep understanding of blockchain technology to stake ANKR

- Ankr allows you to use different features to earn even more rewards

- ANKR is one of the most used cryptocurrencies in the decentralised crypto space

- Ankr can benefit from the advantages of different blockchains

Cons

- Stakers can incur in a loss of funds because of slashing – a practice that allows the network to reduce a staker’s funds if they detect a bad behaviour

- ANKR staking might seem less intuitive than other PoS cryptos, because you still need to know how the different protocols work

- High volatility could significantly harm your staking rewards

Table of Contents

What is ANKR Staking?

Only blockchains with PoS or derived consensus mechanisms support staking.

Ankr is precisely one of those protocols that use such a consensus mechanism.

This has advantages for both the network of participants and for everyday users for mainly two reasons:

- It favours the decentralisation of the network, making it less subject to hacking attacks;

- It allows people to earn staking rewards without needing to do active trading.

The security of the network makes it more reliable, and this is not an aspect that should be undervalued in the financial space in general – and in the crypto space in particular.

Allowing the network to be managed by countless computers makes it not prone to single points of failure, and at the same time no central authority can prevail.

Staking is a useful consensus algorithm when networks want to reach high levels of security and make participants more involved in the system.

Actually, ANKR stakers are active in protecting the whole network, they play a major role. In spite of this, they don’t need to do anything particular.

But, as we mentioned, Ankr went further in allowing people of any levels of experience in the crypto world to obtain more earnings according to their capabilities.

How to stake ANKR?

Binance Earn is one of the platforms offered by cryptocurrency exchange Binance. It comprises a suite of products to help users bolster their cryptocurrency holdings.

This includes staking ANKR. Below is a step-by-step tutorial on how to stake ANKR on Binance Earn.

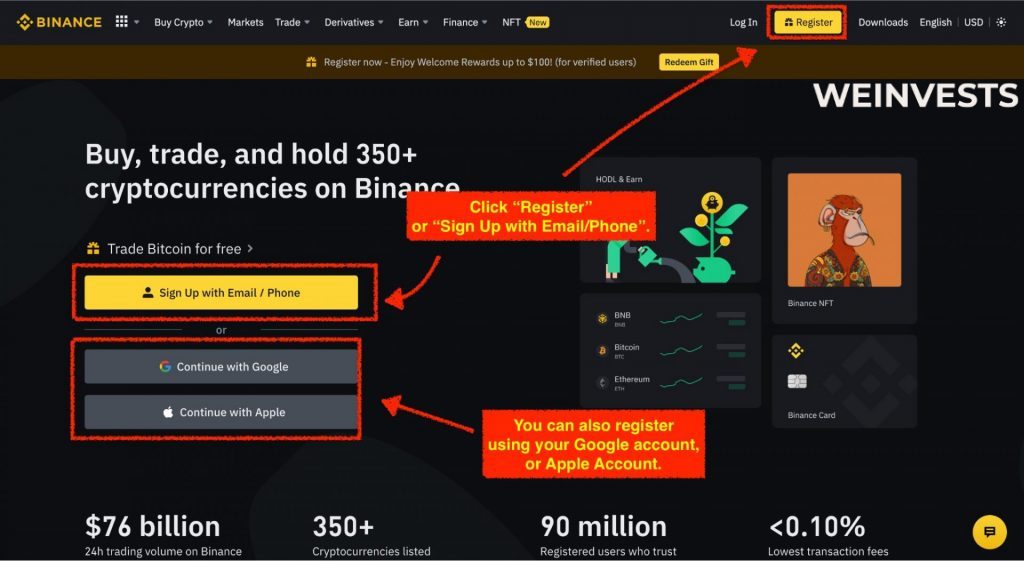

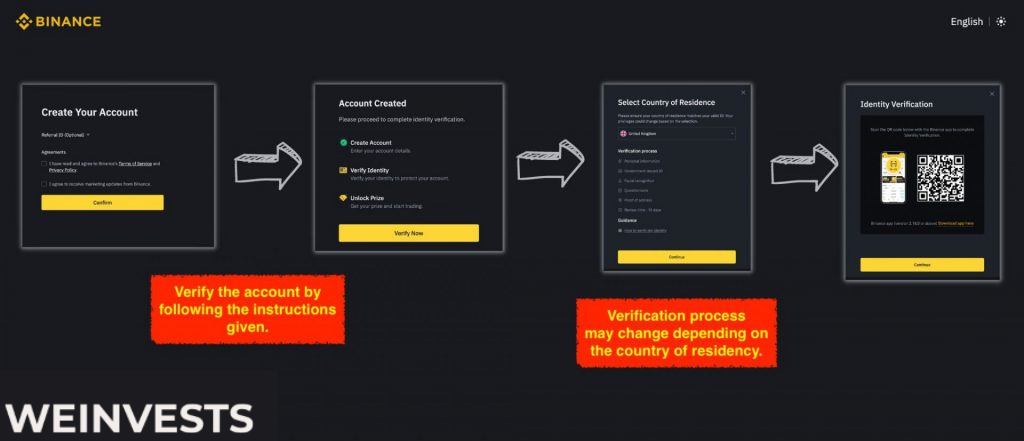

Step 1: Sign Up and Verify your Account

If you want to stake ANKR, the first thing you must do is create an account on Binance.

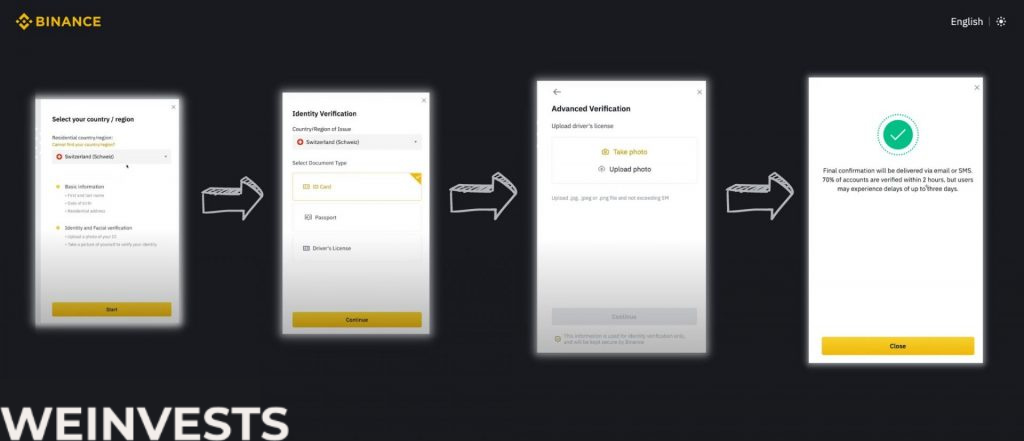

Then go through the verification steps to provide Binance with proof of identity.

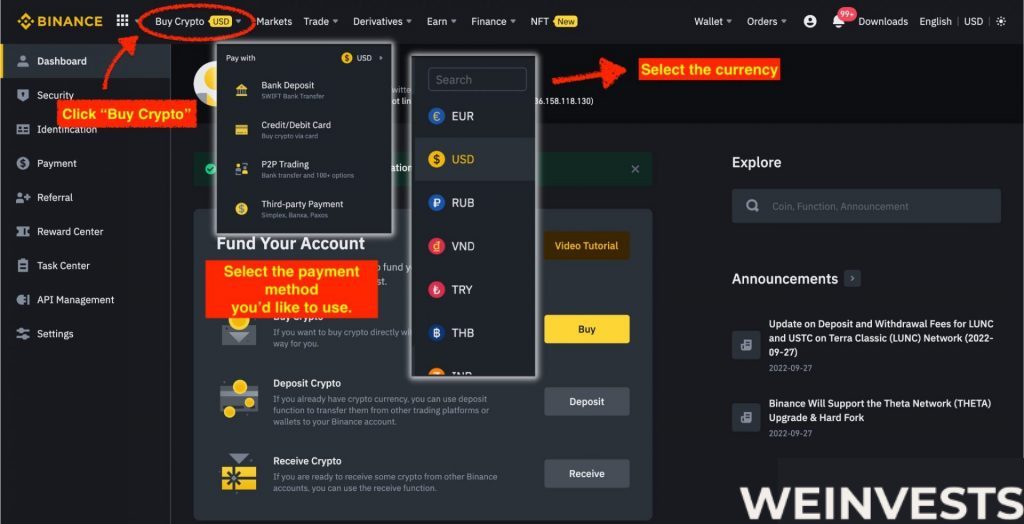

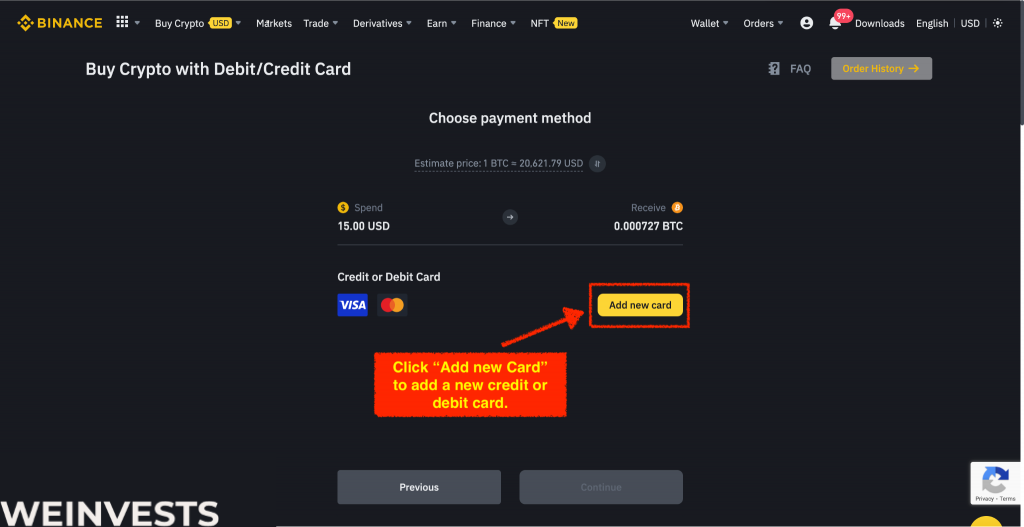

Step 2: Fund your Account

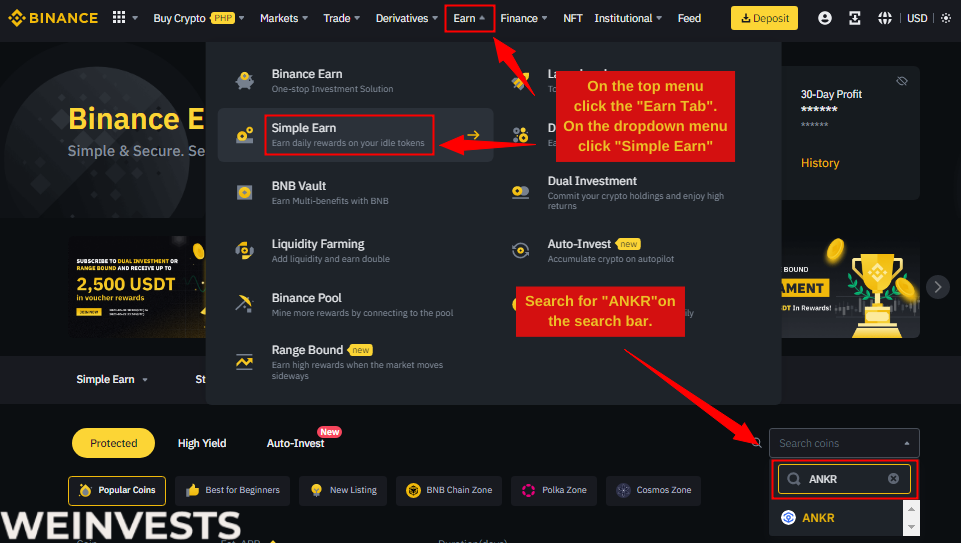

Go to the drop-down menu labeled ‘Earn.’ Here, you will have multiple options. Click on ‘Binance Earn’ and then search for ‘ANKR’.

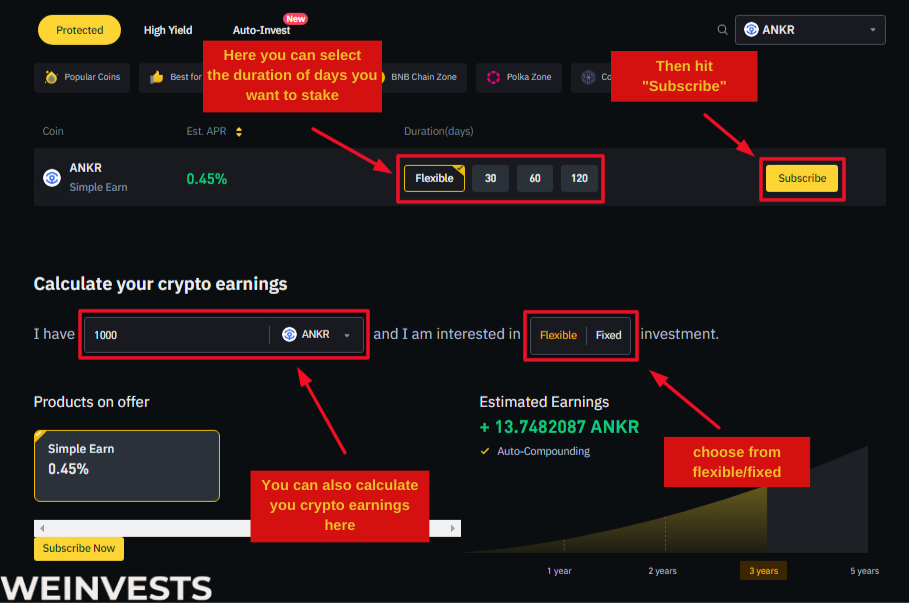

Step 4: Analyze the Staking Parameters and Stake

Here, you can analyze ANKR using the ‘Calculate your crypto earnings’ feature. You can input the amount you want to invest and see the projected earnings for 1 year, 2 years, 3 years, or 5 years. Simply click on the desired number of years to invest in ‘ANKR’.

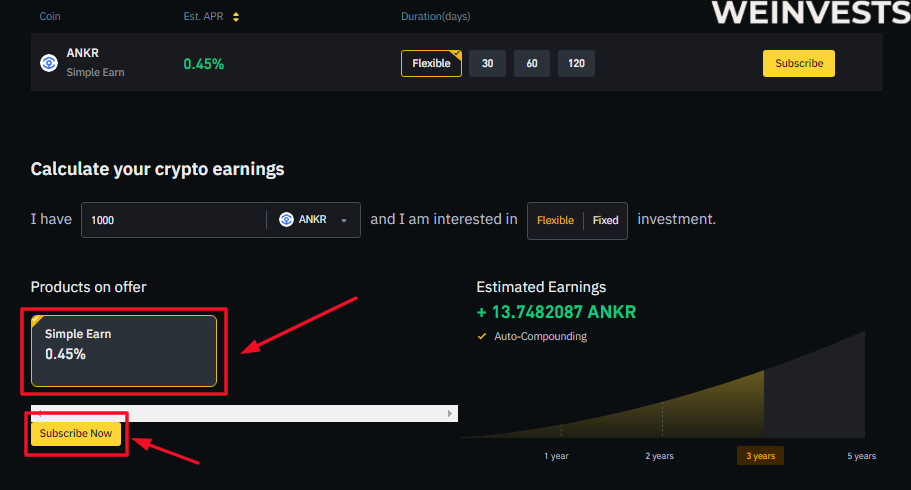

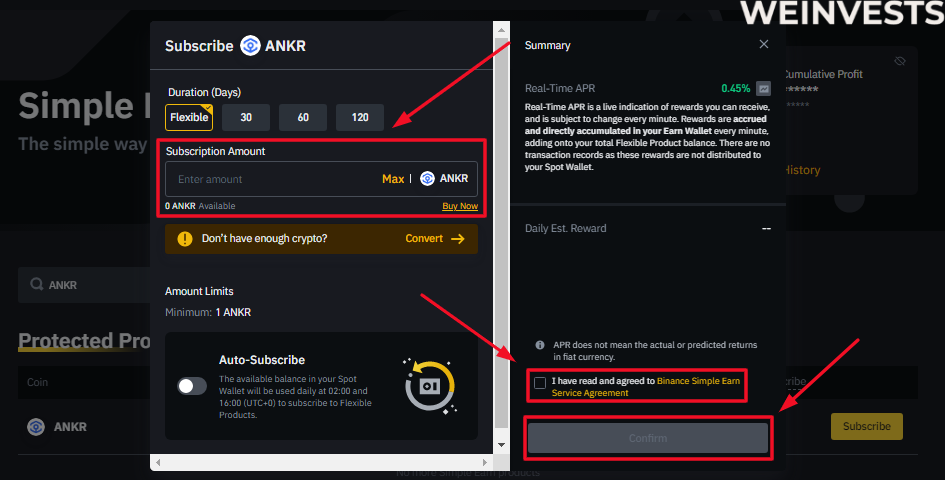

If you want to earn rewards with your ANKR on Binance.com, you can go to the “Products on Offer” section under “Earn” and choose between two options: “Simple Earn” and “Flexible DeFi Staking”.

“Simple Earn” lets you deposit your ANKR in flexible or locked products and earn daily rewards. You can subscribe or redeem at any time, so you can maintain your assets’ flexibility and liquidity. The rewards are sourced from Binance’s own funds and are based on the market conditions.

ANKR Staking Tax

Taxation is not an easy topic when it comes to cryptos – and ANKR makes no exception.

The UK appears to occupy a middle ground between the approaches of countries that are very strict when it comes to crypto regulation, and the approach of crypto-friendly countries.

In any case, the UK approach seems to follow a common practice that involves treating crypto taxation similarly to stock taxation.

Despite this, there are many concerns about crypto asset taxes among traders and investors, also when they’re familiar with more traditional stocks.

Generally speaking, there are mainly two ways to consider crypto assets: they can be taxed as capital gains or income taxes. The way they’re considered depends a lot on how the investor uses them.

When you earn crypto returns, you must convert them to GBP taking into account the exchange rate at the time you withdraw them. In fact, withdrawals play a major role when it comes to crypto taxation: if you don’t withdraw your cryptocurrencies, they won’t be taxed.

It seems a weird statement, but if you keep holding your crypto assets, they won’t be subject to taxation because actually they wouldn’t be a part of your income.

Considering crypto staking rewards as capital gains or as a part of your income will also modify the amount of taxes.

When ANKR staking rewards are considered as capital gains, stakers don’t have to pay taxes if the amount of the gains is less than £12,300. If your rewards exceed this amount, you’ll have to pay 10% of the additional gain if the basic tax rate band applies. 20% in all the other cases.

If crypto earnings are considered as part of your income, the income tax will apply, and the percentage can reach 45% according to your tax band.

It is always advisable to seek the counsel of a tax expert when it comes to crypto asset taxes, particularly since the crypto space changes rapidly and the regulatory frameworks that govern it tend to change frequently as well.

Why do people like Staking ANKR?

Many crypto users are becoming more interested in staking ANKR, for more than one reason:

- It’s focused on decentralisation,

- It allows users to choose different staking systems according to their crypto and financial knowledge,

The ANKR project is particularly exciting, and although it is managed through a complex process that employs several features and systems to earn staking rewards, the final user should be able to interact with it intuitively.

Furthermore, as we said, ANKR staking is a low-risk activity when compared to other activities like trading. – always keep in mind the possible risks we’ve covered in this article.

It’s important to mention other two elements that make Ankr an inclusive project:

- It’s fully compatible with Ethereum,

- It has a finite supply – set at 10 billion ANKR – that contributes to protecting the value of the token.

Conclusion

Ankr manages to mix features that are common in the crypto space, and features that are completely innovative.

Ankr can support multiple blockchains, allow stakers to use different tokens and to earn rewards from different crypto projects.

It uses a common consensus mechanism, proof-of-stake (PoS), which is precisely what allows users to earn staking rewards, but at the same time Ankr has some peculiar elements.

It really focuses on decentralisation – anyone can run a node, without the hardware and software requirements necessary when working with other top protocols.

This considerably lowers entry barriers and actually favours decentralisation.

Moreover, it offers various systems to stake ANKR and earn rewards, and stakers can choose also according to their capabilities.

At the same time, anyone can decide to stake ANKR by using the more traditional system used on both centralised and decentralised exchanges.

All these elements make Ankr popular, and also unique.

ANKR Staking FAQ’s

What is ANKR staking?

The proof of stake algorithm allows for ANKR staking. Users who want to stake ANKR can choose to stake ANKR by themselves, or even to delegate other validators.

ANKR staking is just a way to earn passive crypto income by practising a low-risk activity – staking consists in holding your crypto assets.

Users still have the choice between a decentralised or centralised approach – in the former case, they would just need a compatible crypto wallet to store their assets, in the latter case they would need to activate an account on a centralised exchange that provides staking services.

You will select how much to stake and earn staking rewards by following the steps below.

Why is staking ANKR different?

ANKR staking is different for many reasons, which have to do with the very design of the protocol. Ankr focuses on decentralisation, solving liquidity issues faced by many projects in the decentralised crypto space, and cross chain compatibility – to give you the opportunity to earn additional rewards from different crypto projects.

Moreover, Ankr offers different systems to stake ANKR – like Liquid Staking and Delegated Staking.

Are the rewards for staking with ANKR taxed in the UK?

Yes. they can be taxed as capital gains or as part of your income taxation. Percentages can vary to up to 45% of your staking rewards – your tax band will influence the taxation applied to your ANKR staking rewards.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More