This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

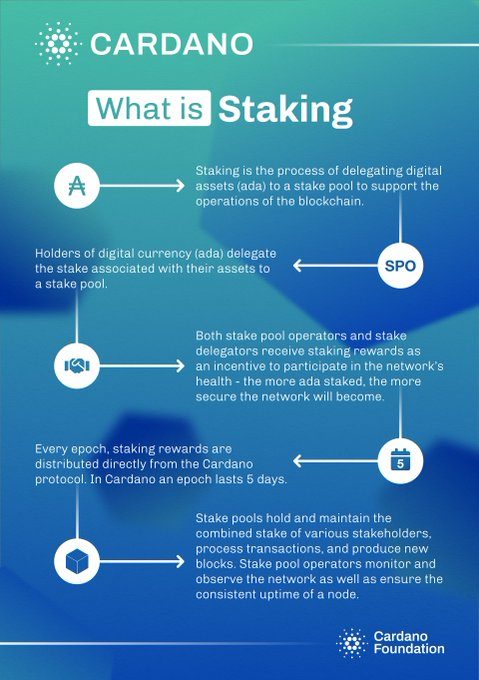

Staking on Cardano is possible because of the implementation of the “proof of stake” mechanism on the network.

Owners of ADA (Cardano) give the staking function up to individuals referred to as “stake pool operators.” A stake pool is simply created when a large number of users combine their assets into one pool, enabling the stake pool to function to increase interest and distribute incentives to token holders.

These are several staking pools that offer users high annual percentage yields after delegation. We will walk you through how to participate in the network and earn realistic rewards on your Cardano.

Below you will find important information about Cardano staking and a proper guide on how you can stake your Cardano.

- There is no specific limit to the amount of Cardano you can stake

- You can get a higher percentage yield compared to traditional investments

- You are assisting the Cardano network to offer better security to users.

- You are required to lock up your funds in a platform or staking pool

- A reduction in the market price of your staked token can defeat the point of staking

- Stake pool operators can be fraudulent and take a good amount of your reward.

- Staking Cardano carries the same level of risk as keeping it in your wallet.

Table of Contents

What is Cardano Staking?

Staking is a procedure by which clients lock their currency in a wallet address in exchange for participating in the upkeep of functions on a blockchain system that is reliant on proof-of-stake. Clients would allocate a certain number of coins to a blockchain’s governance mechanism, taking those tokens out of the rotation for a certain amount of time.

Allowing the Defi network to reach a consensus among nodes is the main objective of the Proof-of-Stake (PoS) network consensus. The Cardano protocol has a lot of fascinating financial and social dimensions, and PoS is not limited to network consensus.

The total quantity of Cardano that a node possesses over the long haul is its stake. A “stake” is an ownership interest that a pool participant holds and that is pledged and secured with Cardano. Due to the fact that it is being kept as security for truthful validation actions, pledged Cardano cannot be accessed or exchanged by the bearer. Users who have pledged Cardano are rewarded with transaction fees. The awards are given out based on how much Cardano a person has staked.

Joining staking pools, which are groupings of Cardano owners who have pledged their coins, allows users to cooperate in updating the ledger, opening new blocks, and gaining rewards.

How to Stake Cardano (ADA)?

Although there are various ways individuals can stake their Cardano (ADA), there are main ways to stake Cardano. These are Binance, Daedalus, and Yoroi.

Binance

The biggest exchange in the world, Binance, also doubles as an online wallet. Any gadget that can be connected to the internet will have access to the Binance mobile app or their official website. A custodial wallet, in which Binance maintains your private key and essentially controls your money rather than you. Binance makes staking very easy.You get 5.09% APY if you lock up your Cardano tokens for a minimum of 30 days.

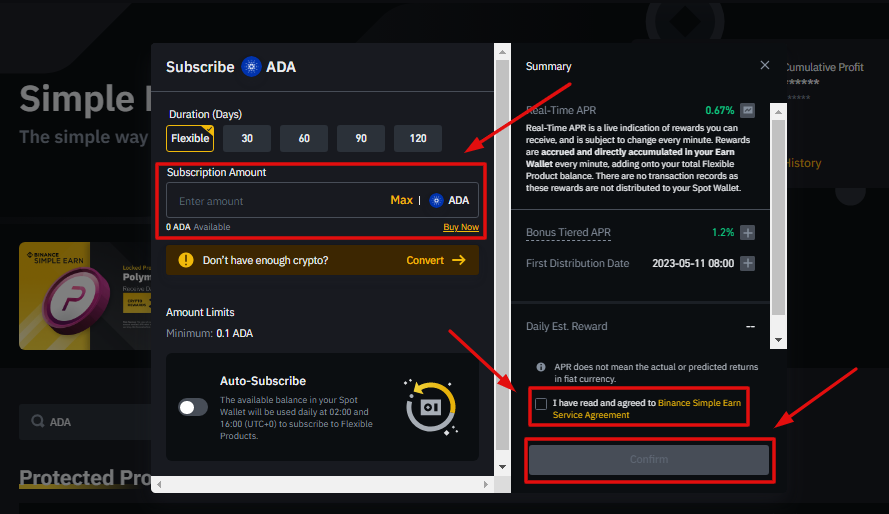

Additionally, you have a choice between a 60- or 90-day lock-in duration. In contrast, the flexible option enables you to remove Cardano coins whenever you like, but your staking profit is then limited to 0.5%. it just costs one ADA to enter to stake ADA.

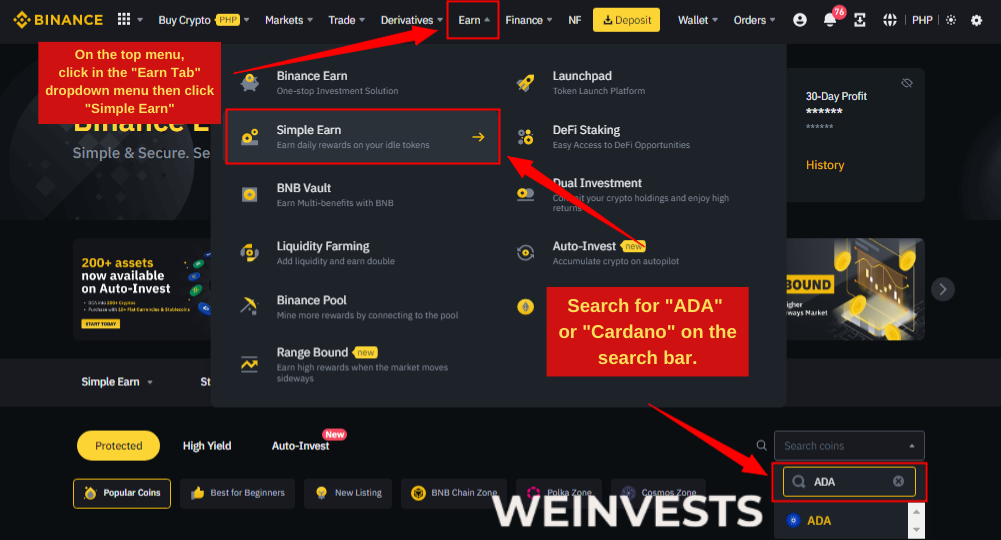

Simple Earn is a feature on the Binance cryptocurrency exchange platform that allows users to earn passive income by depositing their digital assets for a fixed period of time. It is designed for users who want a low-risk way to earn steady returns on their crypto holdings.

One of the ways to use Binance Earn is by staking Cardano. Here’s a detailed guide on how you can stake Cardano on Binance Earn, presented in a step-by-step format.

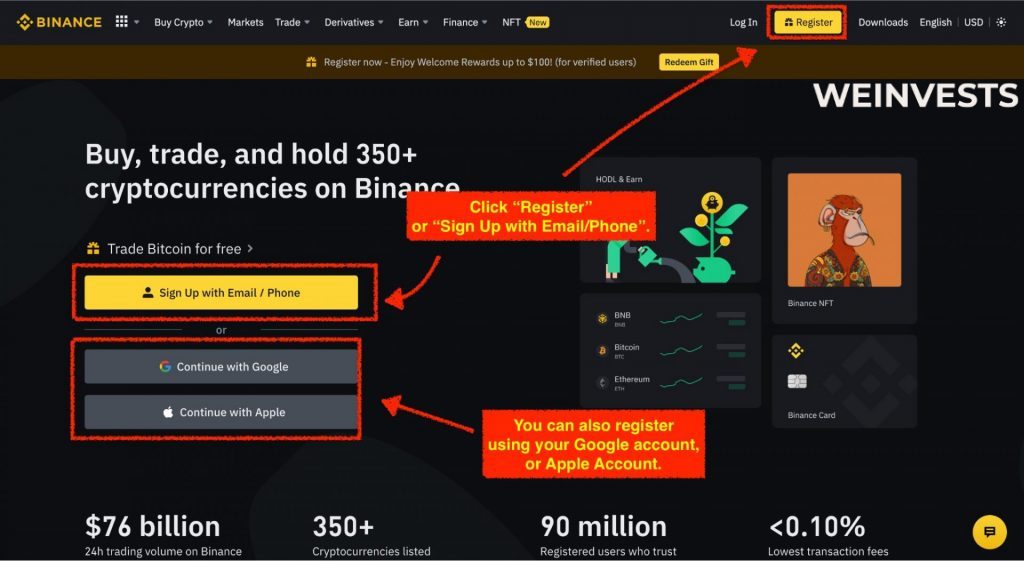

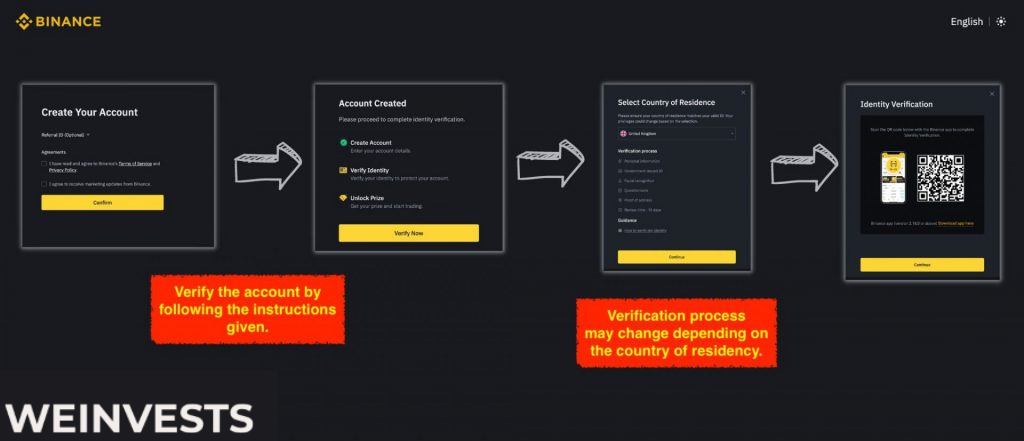

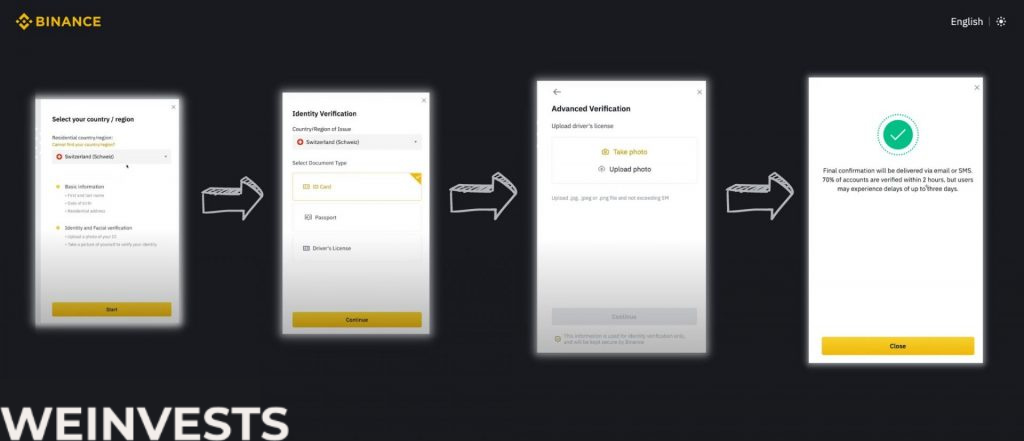

Step 1: Sign Up and Verify your Account

If you want to stake Cardano, the first thing you must do is create an account on Binance.

Then go through the verification steps to provide Binance with proof of identity.

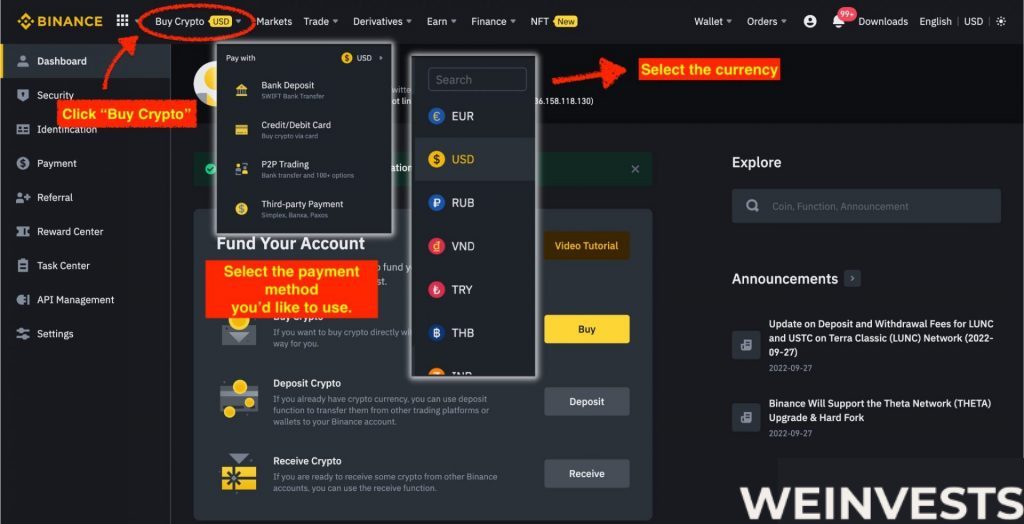

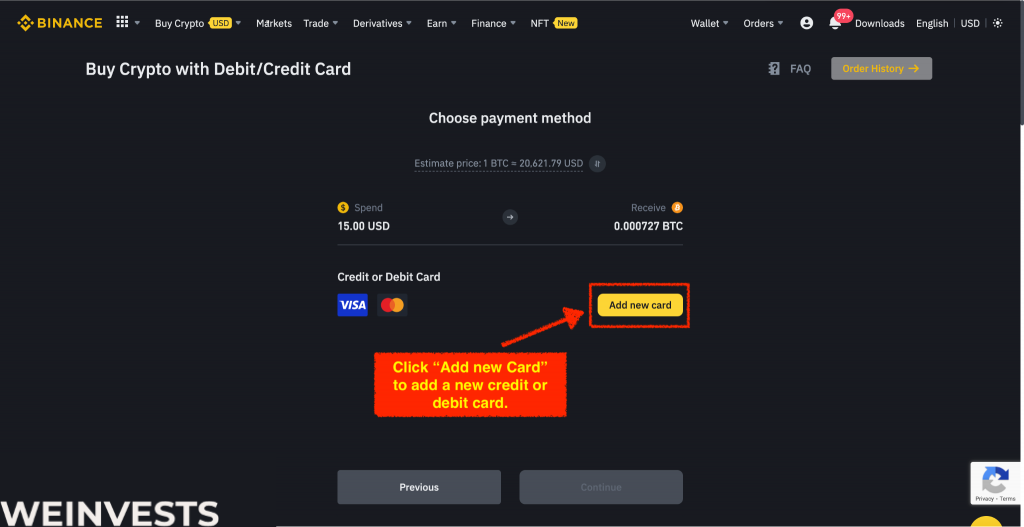

Step 2: Fund your Account

Go to the drop-down menu labeled ‘Earn.’ Here, you will have multiple options. Click on ‘Simple Earn’ and then search for ‘ADA’.

Step 4: Analyze the Staking Parameters and Stake

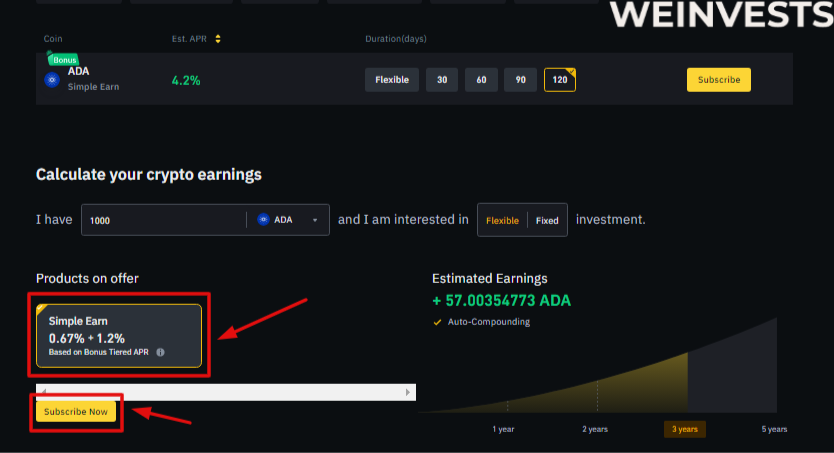

In this section, you can evaluate your potential earnings from Cardano by using the “Crypto Earnings Calculator.” Simply input the amount you plan to invest, and the calculator will display your estimated returns for 1, 2, 3, or 5 years. To view the projections for different investment durations, just click on the corresponding number of years you wish to hold your ADA.

If you want to earn rewards with your Cardano (ADA) on Binance.com, you can go to the “Products on Offer” section under “Earn”

“Simple Earn” lets you deposit your ADA in flexible or locked products and earn daily rewards. You can subscribe or redeem at any time, so you can maintain your assets’ flexibility and liquidity. The rewards are sourced from Binance’s own funds and are based on market conditions.

Daedalus

Daedalus is an open-source wallet, the Cardano group essentially created this authorized desktop cryptocurrency wallet. You can access the complete Cardano network by downloading and running the Daedalus wallet. It is technically a complete node wallet.

You may thus manage your individual Cardano node. You grant the platform your voting power whenever you stake your Cardano coins in the Daedalus stake pool. You will continue to have total control of your Cardano coins, so do not fear. The yearly staking payout is 5%, which is 83-fold more than the 0.05 percent normal savings account interest rate.

Daedalus needs a significant amount of storage capacity since it is a full node wallet, which is necessary for Cardano’s whole blockchain record of all operations, both past and present. To stake your Cardano coin, this wallet is the most protected and cutting-edge choice because it is an authorized IOHK wallet.

Yoroi

Yoroi wallet’s storage volume is less than Daedalus’. It is a more appropriate wallet to stake Cardano tokens because it is less large. Anyone can even install the Yoroi web browser plugin for all of the major platforms thanks to the software’s lightweight design and user-friendliness.

You may sort staking pools by Return on Investment (ROI), staking fee, and pool size to streamline your potential staking returns. Daedalus-like staking rewards are offered, with an annual percentage yield of about 5%.

Exodus

The Exodus desktop wallet is yet another fantastic choice for Cardano staking. You may stake Cardano using Exodus and get up to a 4.91% stake payout. One thing to keep in mind is that Exodus requires a minimum stake of 5 Cardano, as well as a 2 Cardano first-time staking cost in addition to the network fee. Although Exodus shows the entire cost, it is not pricey when you factor in what they offer.

Cardano Staking Tax

Your staking rewards can be disposed of, similar to other crypto disposals, and this is a taxable event.

Depending on how much the cost of your staking compensation has increased or decreased since you first acquired them, you may have a capital gain or loss. Your awards’ fair market value at the date of acquisition can be utilized to calculate the cost basis in this situation.

Income from staking must be recorded at the “time of receipt.” However, in some circumstances, the precise “time of reception” may not be evident.

For instance, some traders who get staking rewards from a third party aren’t sure if they should classify their earnings as earned at the time the incentives are received or when they are withdrawn and deposited into a private wallet.

It’s crucial to comprehend the meaning of “control and dominion” in order to know whether staking rewards are taxable.

Tax analysts predict that if traders have sovereignty and management over their currencies, staking rewards will be viewed as having been “received.” In other words, when coin holders have the freedom to buy, sell, and exchange their coins, investors can declare a profit.

Staking rewards should always be reported as income when filing taxes since this is a prudent course of action.

A more aggressive strategy is to assert that staking earnings are not taxable when they cannot be collected.

For instance, certain sites allowed people to stake their Ether, but withdrawals were prohibited until Ethereum 2.0 was fully implemented. Some investors assert that they do not possess “control and dominion” over their currencies in situations like these.

Why Do People Like Staking Cardano (ADA)?

People stake ADA for various reasons. A good percentage of people stake their ADA because they are looking to hold the assets for a long period of time and would prefer to accumulate incentives in form of ROI for holding ADA.

Others are interested in ADA because they want a higher interest rate than what traditional banks are offering. This is the most common reason why people invest in cryptocurrencies, and it has been one of the most significant decentralized finance innovations because you are paid interest for lending your token to assist the blockchain and improve security.

A high APY can trigger people to stake Cardano at some certain period in time because the APY offered by platforms could change slightly at any given period in time.

Conclusion

Decentralized proof-of-stake (PoS) on the Cardano blockchain was created in 2015 and released in 2017. Given the fact that it does not rely on cryptocurrency mining, it is significantly more energy-efficient than proof-of-work blockchain systems like Bitcoin and has established itself as an alternative.

The objectives driving Cardano’s creation are significant. When voting and blockchain-based treasury management are added to Cardano’s features in the future, its developers envision it finally becoming completely decentralized.

You are now aware of how to stake ADA. Staking in Cardano is quite secure. Your wallet never loses any of the Cardano coins you use for staking. You gain benefits from staking in a manner comparable to earning interest on a savings account. Your coins are always free to be moved or unstaked.

Many investors find staking to be intriguing since it generates passive income. You are also accelerating and stabilizing the blockchain while earning rewards. Staking Cardano can be a game changer in terms of wealth generation, and it is one of the best ways to generate passive income on the blockchain.

Cardano Staking FAQs

Does it make sense to stake your Cardano?

Staking makes sense if you already plan to keep your Cardano tokens for the long haul. The returns are often greater than those of conventional investments, and you will be making a passive income. Staking the entirety of your Cardano tokens has no drawbacks if you plan to retain them for a long time.

How much should I stake to receive Cardano?

With cryptocurrency speculators, staking on ADA might not be the most common strategy. It still outperforms conventional finance, though, since staking up to 100,000 ADA will provide investors with a 30% yield over the course of 5 years.

Is it safe to stake cryptocurrency?

There are a few crypto-staking hazards to be aware of: Cryptocurrency values are erratic and prone to sudden drops. Any yield you receive on your staked assets can be outweighed by a significant price decline of those assets. Your coins may need to be locked up for a set period of time if you want to stake them.

Can you earn a living staking cryptocurrencies?

So, yeah, investing in cryptocurrency pays well. In essence, you need to acquire some coins, hold them, and then add them to the staking pool. The amount you bet and how long you stake it for will determine the earnings you make, which are often in the sort of transaction fees.

Why is staking so lucrative?

Your cryptocurrency generates returns while being staked because the blockchain uses it. Staking-enabled cryptocurrencies utilise a “consensus technique” termed Proof of Stake to guarantee that all transactions are confidential and validated without the involvement of a transaction processor or a bank.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More