This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Theta’s existence aims to address various issues with streaming services, such as Twitch and YouTube. The idea is to create a decentralized platform for content creators that supports fairness, cost-effectiveness, streamlining, and availability.

Beyond the core functions associated with streaming services, the platform also focuses on edge computing and data delivery. Like Etherium, the blockchain it runs on supports smart contracts.

In the cryptocurrency space, Theta is well respected, and its validators are even being run in large companies such as Samsung, Sony, and Google.

Table of Contents

What Are Your Options?

The first point to note is that there isn’t a single option if you are interested in making a purchase. You can choose to do so using an online broker or a crypto exchange. If you go the broker route, while you technically own the currency, you never directly access it.

However, you may find that you have a more streamlined experience, and you can even use CFDs to interact with the assets. On the other hand, should you choose to purchase directly from a crypto exchange, you can access your currency, hold the private key, and transfer it to your private wallet if you wish.

How to Buy Theta on eToro

Streaming services like Twitch and YouTube have become extremely popular over the last couple of years, so it is no surprise that people purchase cryptocurrencies that look to address any problems with these services. Theta is one of the coins people can buy from eToro, so their streaming service runs smoothly.

Theta is becoming so well-respected that big companies like Sony, Samsung, and Google use the validators. If purchasing a Theta coin is what you want to do, the following information will be helpful. Many people use eToro, so the following information will show you how to create an account, so you can start buying.

Step 1: Open an Account

Like with any platform, the first thing that needs to be completed is creating an account. You can go onto the website etoro.com.

It will require you to fill in only the basic information, which only takes a couple of minutes.

You should check out eToro’s terms, conditions, and policies before proceeding to the next step. Additionally, rereading your information to make sure it doesn’t have any errors is also a good idea.

Step 2: Upload ID

Since there are so many scam platforms out there, you need to guarantee that the one you’re trusting is safe. Otherwise, there is no way to make sure that your assets are secure.

In this case, eToro wants to ensure the safety of the users’ cryptos and money. Therefore, everyone needs to go through a verification process, and if you don’t complete it, you’re not able to access the features that the platform offers.

Verifying your identity is not very challenging. You have to upload an ID picture and prove your residence by adding a photo of any utility bill that’s less than three months old.

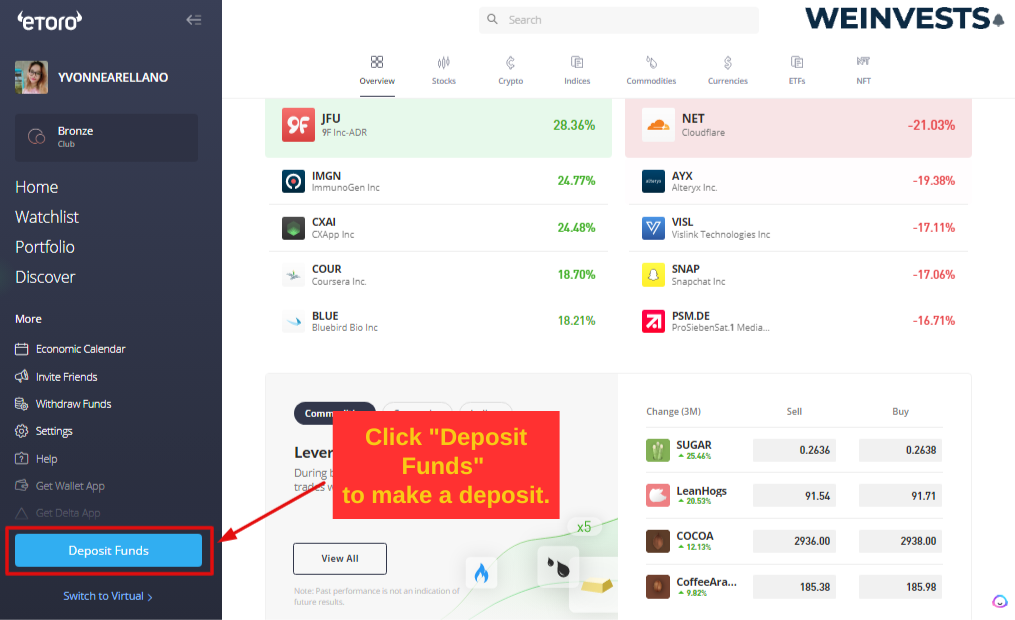

Step 3: Make a Deposit

The next step is to deposit money into the account. This can happen after the account has been verified by eToro, but once it has been, the user just needs to log in to their account and press the ‘Deposit Funds’ button.

Then they will need to choose their currency and payment method.

Many people like that eToro use all kinds of payment methods like Skrill, PayPal, eToro Money, and Neteller, so there are many different ways to get your money into your account.

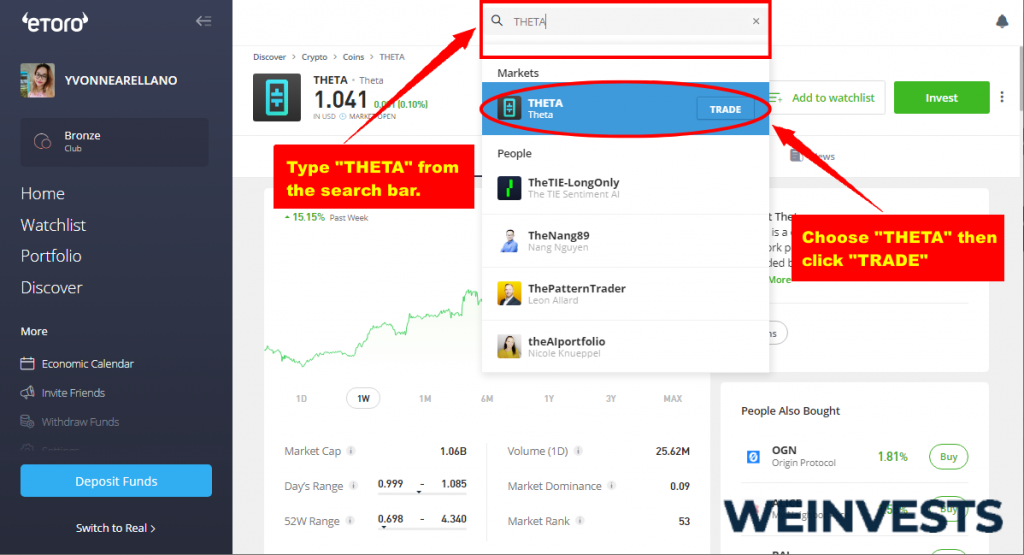

Step 4: Search for Theta

The next step is to find Theta so that the user can buy it. This can be done either one of two ways – searching or by a filter. Searching means that the user can search for the coin itself, which may be the easiest thing to do, but the filter option provides the most detail to the user.

People use the filter option because they can see how Theta is doing amongst the other coins. Two numbers will appear beside each currency, showing how it is doing in the market. These live updates are helpful for those who know how they work.

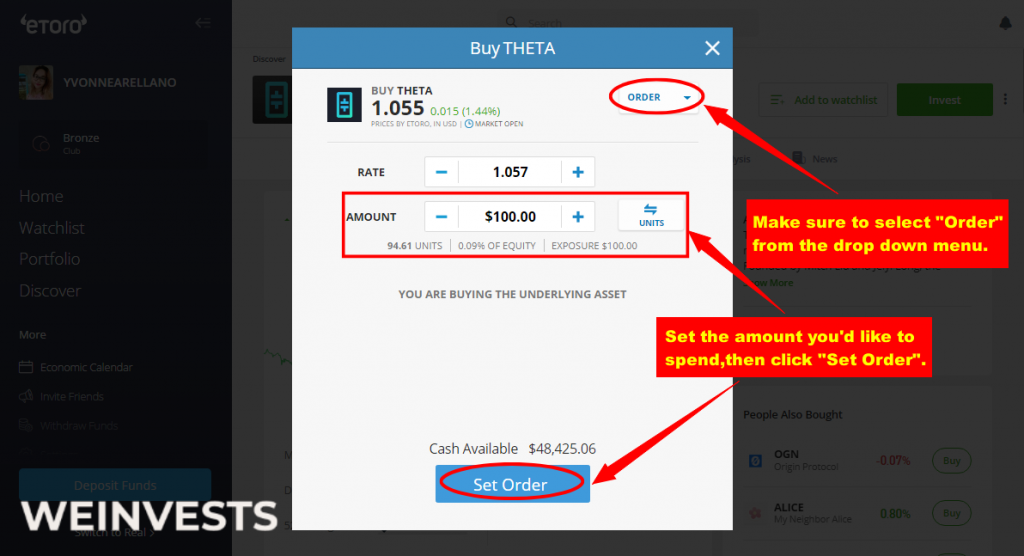

Step 5: Buy Theta

Once the Theta coin has been found, it is time to purchase it. Users can click on the cryptocurrency and have the option of buying a whole coin or part of a coin. This all depends on the person and their needs at that moment.

Registration

The registration process is as straightforward as you’d expect. Simply head to the broker’s website and navigate to the associated signup form. It’s likely going to require a few personal details, such as a name, phone number, and email address. You also decide on your password at this point, and you’re encouraged to make it very strong. A good idea is to choose a phrase you say a lot. Remove the spaces, capitalize all the first letters of the words, and make every other vowel (except “u”) a special character or number.

Before you click on whatever button is present to submit your information and request account creation, there are usually some terms that you must agree to. While you don’t necessarily have to read them before agreeing.

Funding

Provided all the information and documentation above checks out, it’s now time to fund your account so you can begin to make your purchases. Of course, this is another area that depends on what the broker allows.

Nevertheless, some payment methods tend to generally be accepted. Credit and debit cards that bear the Visa or MasterCard branding are almost always an option.

Various payment gateways, such as PayPal and Skrill are also very common to see. Just note that some are faster than others. So, if your platform of choice accepts checks and you decide to send one, your account is not going to be funded until the check is verified. It’s generally recommended to use a credit or debit card for both speed and convenience.

Identity Verification

All regulated brokers need to be able to prove who their users are. On the flip side, it’s a malicious entity and bot mitigation strategy. Following the submission of your information, you’re likely going to get a verification email with a link that allows you to complete the registration process.

In doing so, you are going to need to provide a form of ID to the platform. This must be government-issued, so your passport or national ID works here. Proof of address should also be required, so be prepared to upload a recent utility bill.

Position Open and Close

This part can get a little confusing, especially to the newer traders. As you decide to trade Theta, you can take what is known as either a long or a short position.

The long position is a little easier to explain. Essentially, you choose the trade size and decide on the price at which you are willing to sell. Your broker only acts on your position when the price gets there.

Alternatively, you can take a short position. This is more common for those who believe that the price of Theta is going to fall. If so, you can borrow the asset and sell it immediately.

Under other circumstances, you would be required to own whatever it is you’re selling, but the short position allows you to profit based on expectation.

Going the Exchange Route

Cryptocurrency support is one of the biggest considerations here. However, Theta is not unknown, nor does it lack a reputation. Therefore, you are likely to find it on numerous crypto exchanges.

As was the case when you were choosing your broker, you want to verify the security available with the platform.

You’re going to need a wallet to store your currency upon purchase. There are hardware and software alternatives to choose from. A hardware wallet is physical and tends to be more secure, considering that your private keys are stored offline.

Software wallets are more convenient, but they offer a little less security since a connection to the internet is always required. Note that different wallet providers support different access requirements.

Consider the convenience and ease of access for any solution you are interested in, ensuring it aligns with your future needs.

All you’re doing here is selecting an exchange that sells Theta and joining it, so you can make your purchase. Binance and FTX are two of the premier options that you can investigate. Registration is required here, which is not too far off from what you would have done if you went with a broker.

This means putting in some personal details, as well as proving your identity and residence.

Again, this boils down to what the platform you have chosen supports. Some give more of a spread than others, but credit or debit cards and e-wallets tend to be supported almost across the board. Bank transfers and payment gateways may also be present.

Of course, you want to choose based on convenience, as well as speed and the fees you’re going to have to pay. Your location may also restrict the available payment methods even more.

Ensure Theta is selected and choose the amount you are interested in. Once you enter the required payment details, that’s about it.

Upon purchase completion, you get your tokens and you then become responsible for storing them. This is where the wallet you would have purchased comes into the mix. The transfer is straightforward.

Simply select the withdrawal option on the platform you are using, after which it’s going to request a recipient address. When you purchased your wallet, you should have been briefed on how to locate the unique address.

Paste it into the exchange, and your transfer is complete. You probably realize that the wallet is optional, considering you can leave the coins on the exchange after purchase. However, doing so takes away the level of control and security that you have.

Is a Theta a Recommended Investment?

From a percentage standpoint, it has even beaten Ethereum and Bitcoin in returns for at least one calendar year.

Final Remarks

With so many big players interested in what Theta has to offer, it’s not hard to understand why you may have a vested interest in purchasing it. Luckily, doing so is not a challenge, and you are even offered two distinct options that you can choose from based on your needs and convenience.

The information above provides you with the details you need to potentially take advantage of what Theta can become.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More