This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

XRP has a taste of both worlds.

Fundamentally, it is almost impossible to predict XRP’s next move.

From:

People labelling XRP a centralized banker’s coin

SEC naming XRP/Ripple a security and legal prosecuting it.

XRP potentially replacing SWIFT and skyrocketing into a trillion-daily trading volume Mega network.

Canadian exchanges delisting XRP

To: XRP most recent huge whales’ investment.

When you’d think XRP had had enough, the Bank of England, which has so far invested hundreds of millions in XRP, recently dropped a bomb that even Bitcoin could become worthless if XRP wins its case.

XRP use case suggests immense bullishness in recent months or years; if it wins its case and the current massive market-markers’ investments hold up.

Currently trading around $0.79 as of December 15 against the USD, XRP has been relatively bearish in 2021 and 2022. Today’s price of XRP is at around $0.383564, with a 24-hour trading volume of almost $857,293,012. It has risen 1.27% in the last 24 hours. Currently, it is ranked seventh on the CoinMarketCap, with a market cap of approximately $19,329,869,837. Its circulating supply is 50,395,461,568 and it has a maximum supply of 100,000,000.

Read more to discover our expert technical verdict on XRP price future.

Table of Contents

XRP Price Statistics

XRP Price Forecast

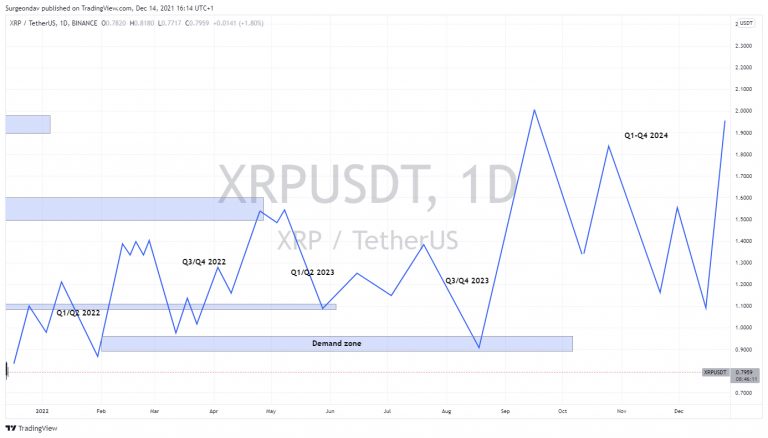

Q1/Q2 2023

If history repeats itself, nothing much is expected of 2023 Q1/Q2.

The price may experience a dump after the bullish move of the last quarters of 2022 to fill whatever imbalances the market might have left behind in its structure.

As is usual with XR, if it either makes a significant bullish or bearish move, what follows immediately is a range or consolidation as a preparation to make its next significant move.

These quarters may fall victim to the range period.

Q3/Q4 2023

We expect the two last quarters to complete the bull cycle for this year.

And before they can achieve that, they must short to find a demand zone where they can gather demand strength to pull price higher, perhaps to test the ATH zone or even mitigate the ATH, driving the price to above $3.

Q1-Q4 2024

We are already getting farther to the market history, so it might be challenging to have an overview projection of the price reaction for this year.

However, if the price successfully achieved a new ATH in 2023, 2024 will be full of bearish movements the same way the price played out in April 2021 when the price hit a new ATH.

In conclusion, XRP is so balanced on the bullish and bearish line that it could very possibly swing either way.

In the short while despite its surface bearish trend, betting on XRP bullishness might not be as so foolish after all.

It’s use-cases, potential outcome of its present case success and the current investments of big banks and market movers in XRP are all good incentives of a potentially significant appreciation. Of course, it could go both ways.

XRP Price Technical Analysis

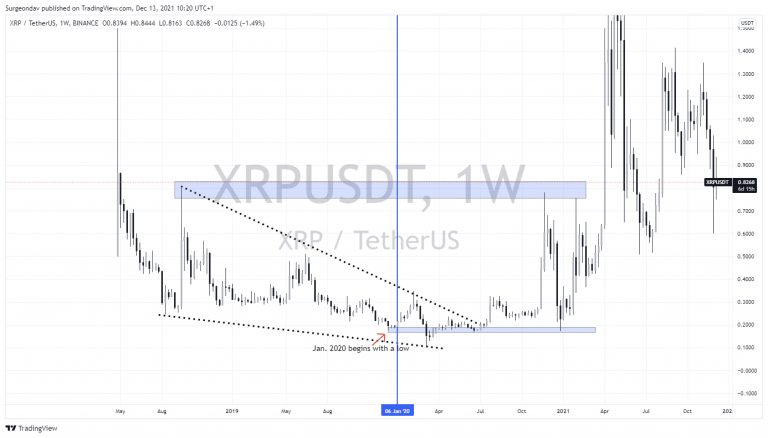

2018/2019 Price Summary

In 2018 and 2019, XRP headed down the same bearish path as some altcoins, establishing lower highs and lower lows in the weekly market structure with strong momentum candles.

The price made a falling wedge pattern in its fall, which indicated the price reversal was a few swings away; a few candles later fulfilled that prophecy.

The following bullish high consolidation after January 1, 2020, bearish pattern held until March’s low mitigated January’s low into trading fluctuations of higher highs and higher lows.

Q1 2021

2021 kicked off with a new bullish movement that got bounced off and halved to the downside by a psychological resistance at its first attempt to make a higher high.

The bounce retracement discovered an intraday demand that halted its retracement and sent it back to the upside with a momentum strong enough to break the two-times tested resistance into the $0.78 price zone.

Unfortunately for XRP, a resistance zone created on September 17, 2018, was already waiting for the price to come to test it.

As it is natural, this long-term foe proved stronger; the resistance bounced back the price with a bearish strength equal to its earlier buy momentum, selling it down to the marked broken/retested support zone.

Fortunately, this new support zone rejected the sell movement, struggled to buy a little, and encountered an intraday resistance that again resisted the price to 50% of its first buy move.

The market then picked up a strong buy momentum to the Sep 2018 created resistance zone.

The resistance zone held to sponsor a sharp sell from $0.75 to the $0.34 price zone, before finally finding support at a then-existing Feb 2020 created resistance zone.

Q2 2021

Q2 started with a bullish consolidation on April 1, then rallied up to break the immediate resistance.

The price immediately gathered momentum from the new resistance turned support zone and launched to around $1.1.

But the price couldn’t push higher and had a 50% retracement of its buy impulse leg that started on April 1.

After the retracement, the price found support by creating a demand zone to push it to around $1.5.

It consolidated a little at the $1.5 zone, then rallied higher to $1.96 to create its present, still unbroken ATH.

The ATH ended the market’s bullish trend and dipped the price into a bearish movement of lower highs and lower lows.

The bears then took the market to a wick zone, retesting 50% of the wick.

In response, the price retraced to the upside before resuming its bearish move all the way to the already created demand zone support that, fortunately, held.

The support zone ended the bearish play to initiate the bull run of higher highs and higher lows, leaving a demand zone on April 26.

After testing the previous highs, the ongoing bullish run ended at around $1.76.

It then started dipping with what seems to lack a strong momentum; a daily BOS confirmed that the market was now bearish.

Upon breaking the bullish structure, the price retested the April 26 created demand zone support twice.

The last retest experienced a sell rejection at the demand zone strong enough to sponsor a 40% price pump to $1.70.

After the price hit $1.70, it gathered a strong sell momentum and dipped to the April 7-created demand zone.

Once again, this demand zone supported the price, and the bulls got the push they needed to take the price to the upside.

As the price retraced to the 50% Fibonacci level from the demand zone, it continued its sell movement, and this time, the longstanding demand zone couldn’t keep the price from falling to around $0.70.

The bears weren’t done; they retraced the price to around 71% Fibonacci level of the last sell leg, where it finally met a supply zone to reject further sell twice, sending the price back to the Q2 start zone. Q2 ended not long after initiating the Q3 market trend.

Q3 2021

XRP made its only Q3 significant move in July.

It had since only ranged for more than a month before selling for a while.

After a few sideways actions, the price took off from the Q2 start zone and bought upward to an existing supply zone around $1.08.

The supply zone dipped the price in a 15% retracement before it hit a demand zone that sponsored price to continue its buy move, driving it to a 4h supply zone around $1.33.

The 4h supply zone created a high before the newly created high sent the price back to retest the below supply zone.

The supply zone support sponsored the price back to the high zone and ranged for a while before the price rallied to the upside.

This time, it broke the last high with an order block.

The order block, also known as ‘buy to sell candle’, sponsored the strong sell momentum that broke the bullish structure and dipped the price to an already created demand zone.

Another buy started from the demand zone but had a wick rejection at around 61.8 fib zone, and since then, the price kept shorting till broke the demand zone, only to start ranging after.

Just like Q2, Q3 ended in this range.

Q4 2021

The price started Q4 by rallying up to test its last significant high, creating liquidity.

The created liquidity mitigated and caused a 40% price retracement to a 4h demand zone.

Then, it made higher highs and higher lows until it reached the OB zone and tested the order block.

Immediately it tested the order block; the price started selling, causing a bearish BOS as it continued to make lower highs and lower lows.

Then the price dipped lower to test the Q2 start zone the third time before it experienced a wick rejection and since then has been ranging.

2022

During the previous year, the price of XRP attempted to reach the $2 level. It failed to break the $1.30 barrier. The bull market in 2022 has already come to an end, and it has caused a significant bear run. Following the bear run, the price of the cryptocurrency went through a consolidation between the range of $0.20 and $0.557.

XRP Price History

| Date | Open | High | Low | Close | Adj Close | Volume |

| Dec 15, 2021 | 0.810394 | 111.704834 | 0.779814 | 0.783773 | 0.783773 | 2,584,425,472 |

| Dec 01, 2021 | 0.998190 | 1.018269 | 0.614505 | 0.796249 | 0.796249 | 44,762,184,598 |

| Nov 01, 2021 | 1.113153 | 1.347662 | 0.896573 | 0.998754 | 0.998754 | 113,672,805,966 |

| Oct 01, 2021 | 0.953764 | 1.227663 | 0.945355 | 1.113247 | 1.113247 | 116,605,183,396 |

| Sep 01, 2021 | 1.186915 | 1.413767 | 0.838255 | 0.952636 | 0.952636 | 134,595,426,158 |

| Aug 01, 2021 | 0.745941 | 1.349174 | 0.697836 | 1.187593 | 1.187593 | 166,787,599,549 |

| Jul 01, 2021 | 0.704785 | 0.768149 | 0.517910 | 0.747786 | 0.747786 | 73,024,306,974 |

| Jun 01, 2021 | 1.042102 | 1.099639 | 0.512710 | 0.706374 | 0.706374 | 98,957,227,517 |

| May 01, 2021 | 1.598409 | 1.758820 | 0.652254 | 1.046584 | 1.046584 | 307,291,184,156 |

| Apr 01, 2021 | 0.573959 | 1.964997 | 0.559002 | 1.591674 | 1.591674 | 481,624,604,752 |

| Mar 01, 2021 | 0.415109 | 0.602618 | 0.413587 | 0.573869 | 0.573869 | 134,191,839,512 |

| Feb 01, 2021 | 0.492512 | 0.744821 | 0.344269 | 0.414953 | 0.414953 | 293,948,049,804 |

| Jan 01, 2021 | 0.219845 | 0.499702 | 0.215816 | 0.492314 | 0.492314 | 212,706,485,107 |

| Dec 01, 2020 | 0.664515 | 0.679158 | 0.174831 | 0.219846 | 0.219846 | 357,938,635,331 |

| Nov 01, 2020 | 0.239739 | 0.768019 | 0.228772 | 0.664337 | 0.664337 | 277,581,515,059 |

| Oct 01, 2020 | 0.242368 | 0.263463 | 0.230124 | 0.239744 | 0.239744 | 54,258,339,507 |

| Sep 01, 2020 | 0.281612 | 0.303214 | 0.220625 | 0.242311 | 0.242311 | 42,008,569,933 |

| Aug 01, 2020 | 0.258904 | 0.324403 | 0.255844 | 0.281766 | 0.281766 | 65,782,526,471 |

| Jul 01, 2020 | 0.175750 | 0.259601 | 0.174234 | 0.258904 | 0.258904 | 38,625,961,278 |

| Jun 01, 2020 | 0.202834 | 0.214335 | 0.174489 | 0.175870 | 0.175870 | 35,578,383,227 |

| May 01, 2020 | 0.212858 | 0.226340 | 0.188483 | 0.202906 | 0.202906 | 61,956,266,331 |

| Apr 01, 2020 | 0.174315 | 0.235703 | 0.169134 | 0.212761 | 0.212761 | 61,696,848,910 |

| Mar 01, 2020 | 0.231105 | 0.245920 | 0.115093 | 0.174563 | 0.174563 | 75,868,716,576 |

| Feb 01, 2020 | 0.239191 | 0.343972 | 0.226173 | 0.231193 | 0.231193 | 87,190,811,881 |

| Jan 01, 2020 | 0.192912 | 0.251187 | 0.185846 | 0.239233 | 0.239233 | 54,593,441,850 |

| Dec 01, 2019 | 0.226466 | 0.233737 | 0.178485 | 0.192894 | 0.192894 | 40,316,503,335 |

| Nov 01, 2019 | 0.296389 | 0.313278 | 0.207013 | 0.226474 | 0.226474 | 54,964,061,382 |

| Oct 01, 2019 | 0.256213 | 0.310290 | 0.244366 | 0.296358 | 0.296358 | 51,233,021,096 |

| Sep 01, 2019 | 0.259171 | 0.322034 | 0.227052 | 0.255933 | 0.255933 | 38,481,735,271 |

| Aug 01, 2019 | 0.320734 | 0.331414 | 0.249951 | 0.259204 | 0.259204 | 32,794,693,243 |

| Jul 01, 2019 | 0.395900 | 0.417618 | 0.291294 | 0.320909 | 0.320909 | 42,214,767,349 |

| Jun 01, 2019 | 0.438711 | 0.505467 | 0.379967 | 0.396411 | 0.396411 | 55,466,087,196 |

| May 01, 2019 | 0.309490 | 0.474619 | 0.294114 | 0.438574 | 0.438574 | 66,586,697,273 |

| Apr 01, 2019 | 0.309195 | 0.374064 | 0.287485 | 0.309476 | 0.309476 | 37,521,700,569 |

| Mar 01, 2019 | 0.315066 | 0.326784 | 0.298987 | 0.309229 | 0.309229 | 21,925,414,930 |

| Feb 01, 2019 | 0.310839 | 0.343676 | 0.290119 | 0.315078 | 0.315078 | 16,987,628,276 |

XRP network

- Has a throughput of about 1500 Transactions Per Second.

- Ripple lab uses RTXP (Ripple Transaction Protocol) in the RippleNet instead of the internet’s HTTP to transfer value worldwide.

- Use the XRP ledger consensus mechanisms where you don’t have to download the entire blockchain before you know the state of the specific transaction states.

- Ripple validators are spread across the world in the Ripple net, and they maintain a shared ledger of who owns what. The make sure transactions sent through the Ripple network follows the RTXP rules.

XRP Tokenomics

- 100 billion total supply

- 1 billion minted monthly

- XRP burns all XRP transaction fees.

- A drop is 0.000001 XRP (least amount of XRP)

- 20 XRP minimum is allowed in an XRP wallet.

Best place to trade XRP with eToro

Ripple has become an extremely popular cryptocurrency. It even tends to rank among the top five most bought cryptocurrencies on several trading platforms. Although it isn’t a costly coin, many people invest in it due to the complexity of its technology. Therefore, if you’re interested in adding this coin to your portfolio.

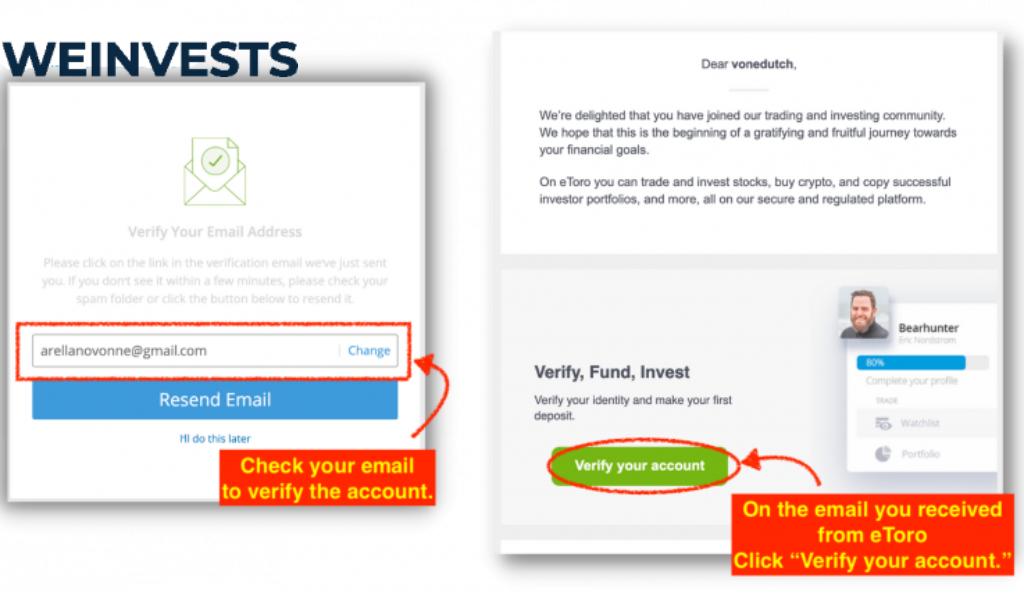

Nevertheless, if you don’t know how to start trading crypto-assets with eToro, the following guide is going to help you get started on the right foot.

Step 1: Open an Account

In order to trade XRP with eToro, you must be registered on the platform, as this is how its creators can ensure all transactions are appropriately regulated. You can do this by following this link to eToro homepage.

It will require you to fill in only the basic information, which only takes a couple of minutes.

You should check out eToro’s terms, conditions, and policies before proceeding to the next step. Additionally, rereading your information to make sure it doesn’t have any errors is also a good idea.

However, before submitting the survey, please review eToro’s privacy policy. When money is at stake, there’s no better way of staying safe than knowing all the parameters that you must follow on the platforms you use.

Step 2: Upload ID

After registering, you can’t start trading before verifying your account. eToro takes the safety of its users very seriously, which is why anyone who joins this platform must go through the KYC process and submit two documents.

- Utility bill

- Driver’s license or a valid passport

- Bank account statement

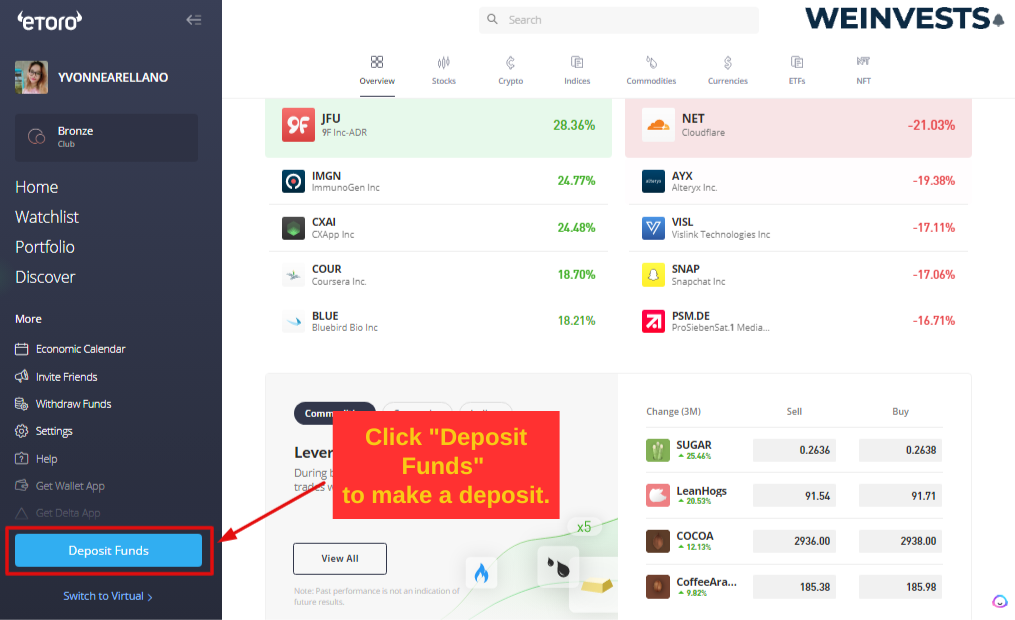

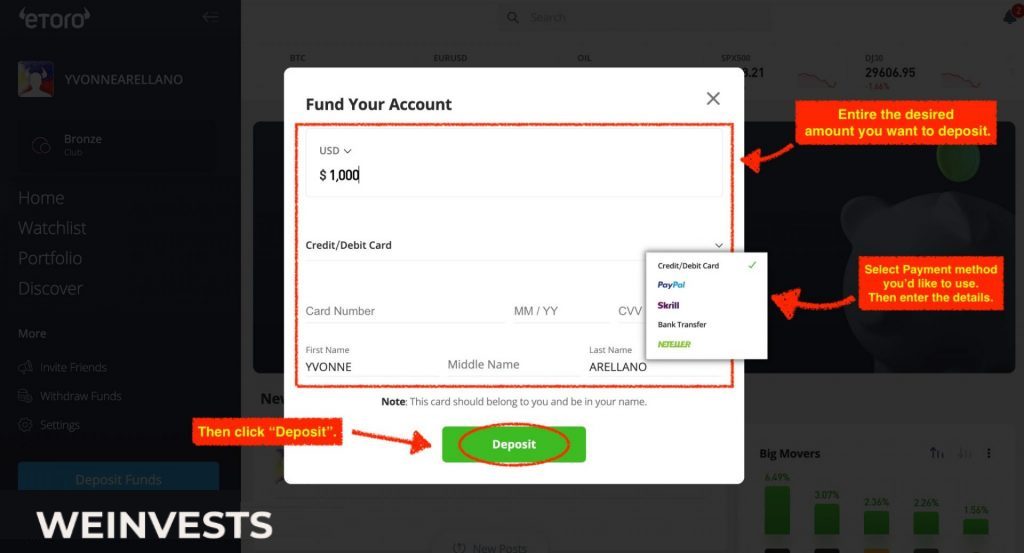

Step 3: Make a Deposit

Now it is time to fund your account. This is going to ensure you have enough money available to trade as much XRP as you want. eToro makes funding its accounts an incredibly effortless process, as it offers several deposit options and doesn’t charge any extra fees. Moreover, it makes sure that each transaction is as safe as possible by securing everything with SSL technology.

Then, you have to type in how much money you want to deposit, your chosen currency, and the payment method.

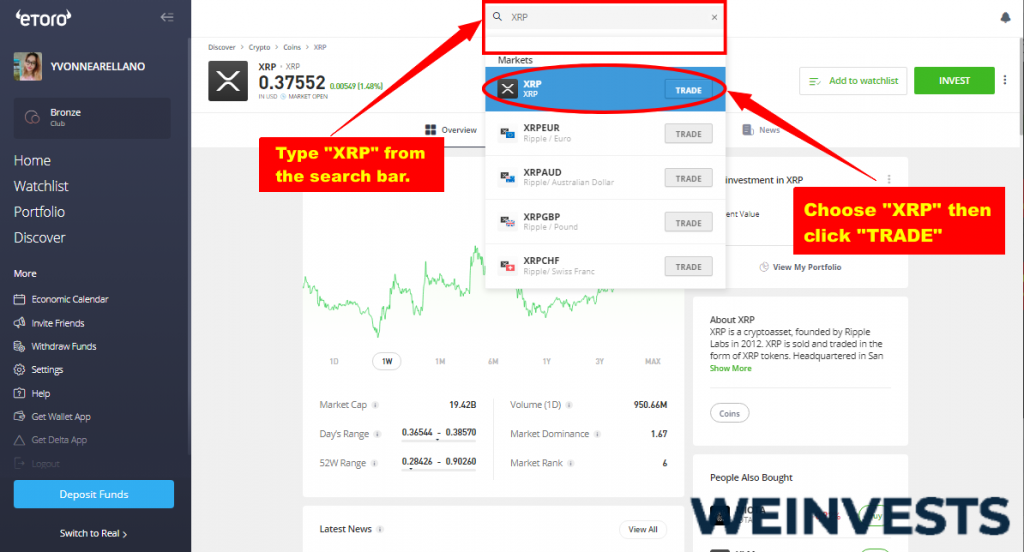

Step 4: Search for XRP

Once you have money in your account, you can go to the discover area on eToro’s platform and start freely buying and selling all the cryptocurrencies you desire. On there, you are going to find all the available cryptocurrencies and several charts and data that explain the current market trend and behavior.

Once you get there, click on XRP, and it may take you to the purchase screen.

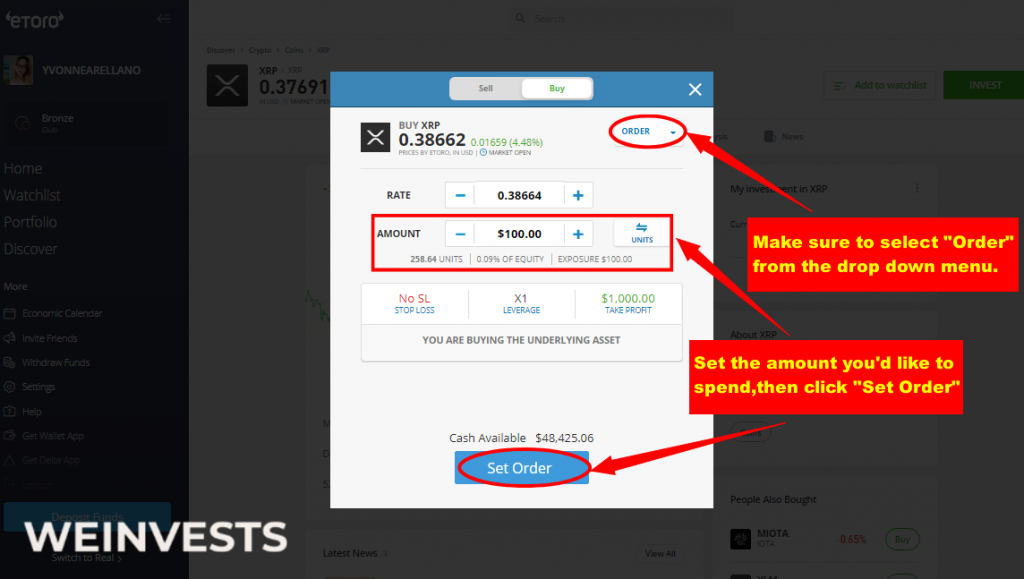

Step 5: Trade XRP

The purchase screen has several options for you to choose from, but executing the transaction is as easy as typing in how much XRP you want to trade. Then, you can comfortably watch how your portfolio grows. Still, please be mindful of the quantities, as sometimes traders make mistakes and trade more than they initially intended.

FAQs

Will XRP ever reach $5?

As of now, there is no concrete evident that suggests a bull run picking up enough Momentum and support to hit a $5 ATH. Although, it is not out of the question.

XRP has one of the most unique use cases out there. In recent years, XRP demand is bound to rise tremendously. The ripple effect of such demands can do wonders to XRP Marketcap.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More