The internal rate of return (IRR) is a financial analysis method that employs the discounted cash flow concept to calculate or estimate how profitable an investment is. This method is a discount rate that makes the net present value (NPV) of a project’s cash flow zero. The term “internal” means that it excludes external factors such as inflation, financial risks, cost of capital, etc.

Calculations of IRR depend on the discounted cash flow formula, as does the NPV. It’s essential to note that the IRR isn’t the real dollar value of the project or investment. The IRR is the rate of return that makes the NPV equal to zero.

When a project’s IRR calculation nets in a high value, it means that it’s likely suitable to undertake. Regardless, whether it’s high enough or not depends on the investor’s opportunity cost and cost of capital. Analysts and companies can use IRR to rank multiple prospective projects on even terms as it doesn’t vary between investment types.

Table of Contents

IRR Formula and Calculation

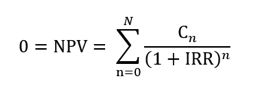

The formula used to determine IRR is as follows:

Where:

Cn = Cash flow during period n

n = Non-negative number

N = Total periods

IRR = Internal rate of return

NPV = Net present value

To use this formula, you must set the value of NPV equal to zero and solve for IRR. The initial investment (C0) is negative because it’s a cash outflow. Subsequent cash flows (C1, C2, C3, etc.) can be either positive or negative, depending on the project’s estimates.

Due to the formula’s nature, IRR isn’t easy to calculate. It requires iterative calculations that are done either through trial and error or with software featuring the appropriate functions, such as Excel.

Calculating IRR in Excel

Using Excel to calculate IRR is considerably easy. It does almost all the work and gives you the discount rate you were trying to determine immediately. The requirement is to combine your cashflows, including the initial investment and the subsequent inflows, using the IRR function.

You can find this function by clicking on the Insert Formula icon (fX). Afterward, you only need to indicate which cells contain the cash flow for which you want to calculate the IRR. It’s necessary to have at least one positive value and one negative. The calculation ignores empty cells, text, and logical values.

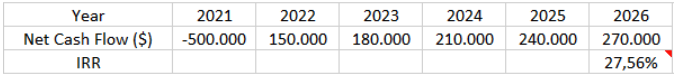

Here is a simple IRR example with known annual periodic cash flows. A company is determining whether a particular project is profitable. This project requires an initial investment of $500.000, but investors expect it to generate $150.000 after tax in the first year and grow by $30.000 annually during the next four years.

The IRR is 27,56% in this case, which can be considered quite good.

Excel has two other useful functions for IRR: the XIRR and the MIRR. XIRR, which stands for extended internal rate of return, calculates the IRR of cash flows that aren’t necessarily periodic. MIRR, which stands for modified internal rate of return, considers investment cost and reinvestment rate of cash flows in its calculations.

What Is IRR Used for?

The capital budgeting process often uses IRR to compare the profitability of implementing new projects over expanding present ones. For example, a thriving business can use IRR to determine the best location to open a second branch office. While a new subdivision would prove valuable regardless of the area, the IRR may suggest a specific one.

Corporations use IRR to evaluate share buyback programs. Suppose a company dispenses a vast amount to repurchase its shares. In that case, the financial analysis should show that its stock is a better investment than any other option for the funds, such as creating new branches or an acquisition.

Individuals can use IRR for their financial choices as well, specifically for evaluating different life insurance policies. They can guide themselves using premiums and death benefits. Policies that have the same installments or premiums and a high IRR are better.

Regardless, life insurance always has a high IRR during the early years because your beneficiaries still get the whole sum even if you die after making a single monthly payment.

Compound Annual Growth Rate and IRR

A compound annual growth rate (CAGR) measures an investment’s annual return over some time. The IRR also calculates a yearly rate of return. Still, they have a crucial difference. CAGR only uses the initial and ending value to provide its estimation, while IRR uses multiple periodic cash flows. Regardless, the simplicity of CAGR makes it considerably easy to calculate.

Return on Investment and IRR

Return on investment (ROI) is a measure to compare investments to other ones or assess their profitability or efficiency. Financial analysts and companies may consider ROI when they’re making capital planning choices. This value informs the investor about the investment’s total growth from beginning to end, but it isn’t an annual rate of return.

On the other hand, IRR calculates the annual growth rate. Both numbers should be identical over a year but distinct over more extended periods.

IRR Limitations

IRR can be misinterpreted if individuals or companies use it in inappropriate scenarios. For that reason, its ideal use is in capital budgeting processes to determine the best-proposed investment for a company.

If the cash flow has fluctuating positive and negative values, then the IRR may have multiple ones. Also, there isn’t a discount rate that can produce an NPV of zero if the cash flow has the same sign, or in other words, the project isn’t profitable at any point.

Although IRR is a popular metric to estimate a project’s annual return, it’s better to use it alongside other methods. Estimates that use IRR or NPV more often than not differ significantly from actual results, so financial analysts combine them with scenario analysis.

This analysis of future events can show different possible NPVs depending on the expert’s assumptions.

Companies that employ IRR do so in combination with a weighted average cost of capital and a required return of investment.

The Bottom Line

The internal return of investment is a method that calculates the expected yearly growth rate of a project or investment. Analysts and investors calculate IRR using the same concept as NPV. However, it sets the value equal to zero.

There are several ways to calculate it, but the easiest one is using an Excel function. It’s ideal for capital budgeting projects where it allows the analysts to rank multiple investment options.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More