This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

A common misconception is that investing is only for well-off people. Don’t fall into this faulty thinking. Getting investments in place to help build wealth is a wise choice, no matter where a person finds themselves.

The first steps may be the most difficult, but they are the only way to start building financial momentum while developing sound investing habits that will pay off in the long run.

Table of Contents

Why Investing is Important?

At every stage of your financial life, investments should be working tirelessly in your favor. The changes that occur are the types and amounts of the assets, not the principle of having your money (large or small) active and working for you. Here are some critical reasons why investing is essential in 2023:

- Your Money Loses Value in a Savings Account – In our current financial environment, a savings account’s interest rate doesn’t match inflation. There are no signs that this will change soon. Who wants to “save” money that is worth less every year? It is a poor recipe for making progress.

- Making Sure Retirement is a Possibility – Without a strong focus on investing, most people will have to work until they are well past 65. Being able to retire while still being able to enjoy the freedom it represents has much more appeal than leaving work at an older age; smart investing can solve this problem.

How to Invest with Your Little Money

If you’re looking to invest with your little money, eToro is an excellent option to consider. As one of the leading online brokers, eToro has built a solid reputation and offers a wide range of options for both beginner and professional traders. In this mini guide, we will walk you through the steps to open an account on eToro and start investing in what you want to purchase like ETFs, crypto, or stocks.

Step 1: Open your Personal Account

To open an account, you’ll need to fill an application form to provide the platform with some personal details, and more information about your investing and trading experience.

Step 2: Upload ID

This is a document that eToro needs to comply with regulations in terms of KYC (Know Your Customer) and AML (Anti Money Laundering).

Documents are required not only to verify your identity but also as proof of residency and proof that you own the bank account you want to use to invest in eToro.

Step 3: Make a Deposit

eToro offers you a virtual wallet to test your trading and investment strategies.

Depositing money will be easy since eToro allows you to use both credit and debit cards.

Step 4: Search for specific stocks you want to purhase

eToro has a wide selection of Crypto, ETFs, or Stocks and if you have something particular in mind, you can use its search bar to find it quickly. After you identify the stock you’re looking for, you can hit the “trade” button to initiate your order. In addition, you can use the available features to determine the stop-loss and take-profit price prices, thereby automating your trading – an important element, if you don’t want emotions to influence your trading activity.

Smart Steps Before You Start Investing

All investing comes with a risk, and returns are not guaranteed. With these two crucial truths in mind, if you have these two issues, resolve them first to establish a solid foundation.

- Pay Off Large Interest Rate Debt – Some credit cards and loans have interest rates it will not be easy to catch up to with investments. While individual circumstances vary, it is often best to pay these debts off as soon as possible.

- Prepare for an Emergency – In uncertain economic times, it is always wise to have a backup plan in case of any surprises. Having three or four months of living expenses put aside in case of a negative turn will allow you to invest and work with more security and peace of mind.

3 Tips on Investing With Little Money

To help build a bright financial future, starting right is crucial. You can cultivate good habits and a positive, forward-thinking mindset as assets grow by choosing reliable ways to invest. The following tips on how to invest with little money can be valuable.

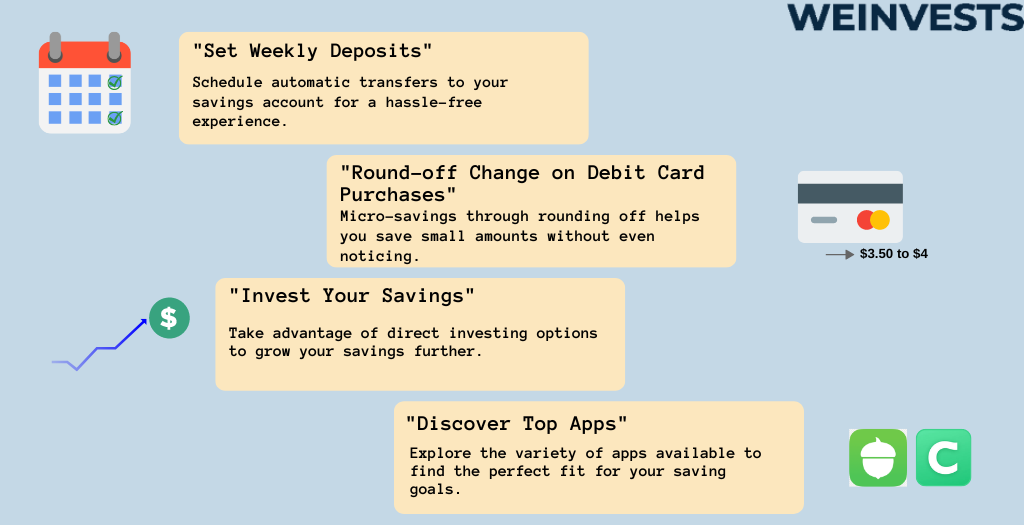

Automate Savings

Finding a way to leverage technology to help hit monthly saving goals is a winning move. There are plenty of apps designed to play this role. Beyond the traditional settings for weekly deposits, a feature that many users praise is rounding off the change on debit card purchases, with the extra going to their savings. This “micro-savings” feature is present on apps like Acorn and Chime, which also allow direct investing.

Invest in an Exchange-Traded Fund

ETFs usually have no minimum amount of money required to begin investing, and they are simple and easy to trade. An ETF is a group of assets bought and sold, with its price rising and dropping during a day like a stock. ETFs can be traded without needing to purchase an entire share, which is a significant part of what makes them appealing. Always check the fee for ETF trades, as they can vary depending on the online broker used.

Explore No-Load Mutual Funds

No-load funds are designed to encourage a smooth investment entry with no or low commissions, charges, or costs. There is only a limited number of these funds, but when available, they can offer significant opportunities for investing success. Vanguard, Fidelity, and Charles Schwab are important brokers providing options in the no-load space. Insiders recommend using a mutual fund research tool like Morningstar to see the available no-load funds and compare their details before committing to an investment.

Strategies for Investing With Little Money

It is nearly impossible to arrive at a destination without a clear idea of where you are going and a map you can count on—investing shares these qualities.

- Set Clear Goals – Are you investing and intending to build up enough money to retire in 15 years? Are you trying to build wealth to buy a home? Will your investments eventually set you up in a new business? Knowing why you are investing is a crucial factor in helping you make the sacrifices required to stay on point. Set clear goals and see the chances of achieving them skyrocket.

- Find Your Investing Niche – Not all investing categories are a good fit for all investors. Some may find that real estate investing comes naturally to them, while others may find the ins and outs of cryptocurrencies enchanting.

- Practice Patience – In nearly every case, investing is more of a marathon than a sprint. High-risk investments with significant returns often share more with gambling than with mature investment strategies. When you invest, think of how your future is built, and be prepared to wait for your returns patiently. The best investors, like Warren Buffet, have preached this kind of mindset and self-discipline, and their results speak for themselves.

Great Platforms and Apps for Investing With a Small Budget

The widespread use of investment apps has changed the face of investing by opening the door for small-budget investors. Starting an account ranges between no deposit required up to $100. While some features are broadly shared, other details can vary greatly, including fees. Here’s a list of some of the most popular apps and platforms for investing with little money. Pick the one that best meets your budget and goals.

Robinhood allows access to stocks, ETFs, and cryptocurrencies, all with no commission fees. The app has won praise for being simple to use for first-time investors.

The Acorns app is designed to automate and maximize savings, do easy investing, and provide integrated online banking services.

Axos Invest allows self-directed, no commission fee, direct investing, and “industry-recognized performance” managed profiles. The app provides investors at every stage of experience with appropriate tools, including Axios Elite for experienced traders.

Stash provides automated stock and crypto investing aimed at helping build long-term wealth. The app delivers personalized investment advice and the option for dividend reinvesting

The M1 app allows investors to create their own investing “pie,” a valuable visual tool that can make investments easier to understand. The option to copy the investment approach of others users is available for those who would like to model more experienced investors. A minimum of $100 is required to get started, which rises to $500 for a retirement account, which can be a step up from other investing app minimums.

FAQs

I only have a little money to start investing with. Is the effort to invest worth it?

Yes, it is. Investing has to start somewhere. The knowledge you build about investing and affirming the habit of investing through taking action are positive factors that can help you even if you are not working with large amounts of money. Also, remember the power of compound interest.

Stocks make me nervous. Are they a necessary part of my investment portfolio?

All investing comes with risk. Historically the stock market, when looked at over a long enough period of time, is among the safest investing strategies. The key is diversity in investments. If something surprising happens with an asset, other assets can help provide additional security.

Should I alter my investing strategies over time?

Everyone’s investing needs are individual. However, if you are investing toward retirement, you should adjust your investments based on how long you have until the planned retirement date.

Is cryptocurrency investing safe?

Most financial insiders consider cryptocurrencies to be more volatile than investing in something like a mutual fund. Only you can determine your acceptable level of risk.

What are good returns?

It’s impossible to predict investing returns in an accurate way. Looking at a stock or fund’s past performance can be helpful when trying to get an idea of future performance. However, this is not certain. Even when looking at funds that average 5% growth a year for 20 years, some years will be much lower and some much higher. Successful investing is all about managing risk vs. the size of returns.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More