This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Trading is a complicated game and requires you to be aware of many factors. Having a good strategy is crucial for success. You need to know the market, which can fluctuate in different directions. You also need to know when it’s time to enter or exit your trade so that your profits don’t get wiped out by a sudden change in direction. One way to make sure that your trades are successful is by using breakout strategies.

In this post, we’ll discuss what breakout trading strategies are and how they can help traders profit from the market!

Table of Contents

What is Breakout Trading?

Breakout trading is a popular stock market strategy used by many traders. It involves analyzing the market for potential breakouts that can result in big profits. Traders who use this strategy often look for support and resistance levels, chart patterns, and market trends. By understanding these elements, a trader can determine when a breakout is likely to occur and take advantage of the potential profits.

The breakout trading strategy is used by traders because it has been shown to be effective over time, with many studies showing that the average return on investments using this approach is higher than other types of trades.

Understanding the Basics of Breakout Trading

Breakout trading requires a solid understanding of technical analysis. Traders need to understand chart patterns, trendlines, and support and resistance levels. By analyzing these factors, the trader can identify potential breakouts and set up entry and exit points.

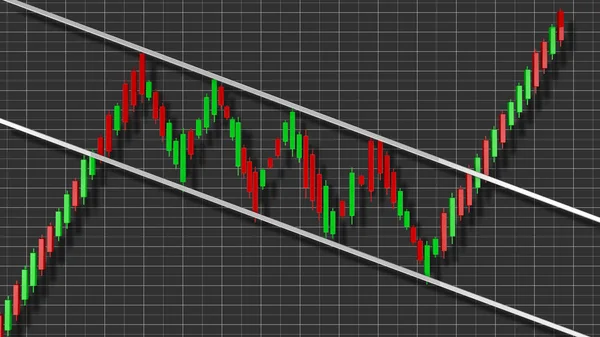

The breakout strategy is simple. You look for a stock’s price to break out of a range it has been trading in for a certain period. This could be a range that has been established for hours, days, weeks, or even months. When the price breaks out of the range, you buy the stock and wait for it to continue moving in this direction.

When analyzing a stock’s price movement, you should look for any patterns that suggest that a breakout may be imminent. This could include chart patterns, such as head and shoulders, double tops, and triangles, as well as support and resistance levels. If you see that a stock is nearing a key level of resistance, it may be a good time to enter a long position.

How To Determine the Best Breakout Point?

To determine the best point to enter a breakout trade, it’s important to consider the overall market sentiment. If the stock market is trending higher, then it’s likely that the price will keep going up, even after the breakout. On the other hand, if the market is in a bearish trend, then the breakout may not last for very long. Other factors to consider when determining the best breakout point include the following:

1. Study Market Trends

By studying market trends and economic indicators, you can better determine when a breakout is likely to occur. This can help you identify the best entry and exit points, as well as determine the most appropriate risk management strategies. You should also pay attention to volume, as this can provide additional insights into the stock’s price movement.

2. Understand Breakout Chart Patterns

Chart patterns are also important when it comes to breakout trading. Traders need to be able to identify potential chart patterns that can signal a breakout. By understanding chart patterns, traders can set up entry and exit points that can be used to capitalize on breakouts and maximize their profits.

Breakouts occur when a security’s price moves beyond a pre-determined or established range. Breakout patterns can be found in many different chart patterns, such as head and shoulder patterns, double tops and bottoms, and flag patterns. The key to successfully trading a breakout is to identify the right pattern and then use the correct trading strategy.

3. Determine Support and Resistance Levels

Support and resistance levels are important when it comes to breakout trading. Traders need to identify key levels where the price is likely to break out. By analyzing the market, traders can identify potential support and resistance levels that can be used to set up entry and exit points. This allows them to capitalize on breakouts and maximize their potential profits.

Once the pattern is identified, traders should look for the support and resistance levels of the security as well as any recent news or events that may be affecting the security. After these factors are identified, traders should then determine the entry and exit points of the trade. This can be done by plotting out the different points on the chart and determining the best point of entry and exit.

How To Trade Breakouts Effectively?

It is important to develop a strategy that works for you and fits your risk tolerance. By understanding the basics of breakout trading, as well as applying risk management and technical analysis, you can increase your chances of success.

Identify the market condition

The first step in this strategy is to identify the market condition. To do so, you have to know the direction of the breakout and also its time frame. The second thing which you need to know about is volume; it should be high enough for taking advantage of your entry signal.

Go Long on Breakouts

The best way to trade breakouts is by going long on them. This means you buy the stock when it breaks out above its resistance level and then wait for it to go up to your target price.

Go Short on Breakouts

The short trade is the opposite of the long. You go short when you think the price will fall, and you want to profit from this fall. To put it simply, your profit comes from selling at a higher price than you bought at.

Place your stop-loss order

One of the most important strategies for breakout trading is the stop-loss order. This is an order that will automatically close a trade if it reaches a certain level of loss. This helps to protect traders from large losses and ensures that they are not overexposed to the market. It’s important to remember to set your stop-loss orders at an appropriate level, such as 2% or 3% below the entry price, depending on the volatility of the security.

Position Sizing

Another key strategy for successful breakout trading is position sizing. This is the process of determining the optimal size of your trades relative to your account size. By sizing your trades appropriately, you can ensure that you are not putting too much of your capital at risk in any one trade.

Trailing Stops

Trailing stops are another useful tool for breakout traders. A trailing stop is an order that will move your stop-loss order to lock in profits as the stock moves in your favor. This can help to reduce losses if the stock suddenly reverses and helps to maximize profits when the stock continues to move in your favor.

Avoid False Breakouts

Finally, it’s important to be aware of false breakouts. These are when security breaks out of a range and quickly reverses course. To protect against false breakouts, it’s important to wait for confirmation before entering a trade. This means waiting for a second confirmation signal, such as a higher high or a lower low, before entering a trade.

By utilizing these tools and strategies, you can increase your chances of success in breakout trading. Stop-loss orders, position sizing, trailing stops, and false breakouts are all important factors to consider when trading.

Technical Analysis Tools to Use for Breakout Trading

The Fibonacci retracement tool is a technical analysis tool that helps traders identify potential levels of support and resistance. This is done by identifying key price points where a security’s price may reverse its trend. The Fibonacci retracement tool can be used in conjunction with other tools such as Bollinger Bands, pivot points, average true range (ATR) and RSI.

The Bollinger band consists of two lines: a moving average line and upper/lower bands that are calculated from standard deviations above/below the moving average line. The widths of these bands vary based on volatility; when volatility increases, so does the width of these bands. Bollinger bands are useful because they provide confirmation signals for breakouts into new territory; when prices move beyond their boundaries with relatively high volume (and without much retracement), this suggests that momentum has shifted in favor of buyers or sellers depending on whether prices crossed above or below their respective averages respectively

A pivot point is the price level at which supply and demand are equal, meaning that neither buyers nor sellers have control over the market. Pivot points can be calculated using historical data or by applying technical analysis techniques such as moving averages or trend lines.

The average true range (ATR) is a momentum indicator that measures volatility by comparing a security’s recent closing prices with its average price over the past periods; this number is then plotted on an exponential moving average chart to determine levels of support and resistance.

The RSI measures momentum in price movements over a specified period of time by comparing upward and downward closing prices with their respective opening prices. The RSI is calculated by subtracting the 14-period exponential moving average (EMA) from a 3-period EMA.

The Breakout Bounce Strategy

This is a strategy that involves buying an asset after it breaks out and trades above its previous high. The breakout bounce strategy can be used in any market, but it works best on markets that have a high level of volatility or are experiencing strong trends. The key components of this breakout trading strategy include:

- A good time frame (1 minute-5 minute)

- An indicator that shows whether the price is rising or falling (such as MACD)

- A second indicator showing whether the trend is up or down (like RSI)

- A third indicator shows whether there’s a high volume being traded at those levels (such as Bollinger Bands). This helps us determine if we’re getting into an overbought/oversold area where there could be a reversal soon.

The Breakout Pullback Strategy

The breakout pullback strategy is a simple trading strategy that can be used to trade a breakout. The strategy is based on the idea that the price will pull back to the breakout point before continuing in the direction of the breakout.

In order for this strategy to work, you must wait for your chosen asset’s price to move through an important resistance level or support level and then place an order at least 0.50 away from that level. If your order gets filled within 30 minutes of placing it, then congratulations! You just scored yourself some easy profits by following this simple rule.

Conclusion

The key is knowing what type of breakout pattern will work best for your trading plan and identifying when those patterns appear on the chart. You also need to know how and where to place a stop loss, so that you don’t lose money on trades that go against you because there will be times when this happens if you trade often enough!

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More