This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

To effectively diversify, you must add more assets to your portfolio that are uncorrelated to the ones you already have.

And for an equity portfolio, this may be as simple as adding different assets like commodities. But you can also accomplish this by adding equities from emerging markets like Russia and Brazil.

Emerging markets have a reputation for decreasing volatility in a portfolio invested in developed markets due to exposure to different equities and currencies.

By buying it, you will get instant access to thousands of stocks across multiple countries. If you attempted to do this by yourself, you would have to face high transaction costs and the work of rebalancing your portfolio by yourself.

But why VWO? The short answer is that it’s the largest emerging markets ETF in the world and the cost of parking your money in it is insignificant.

The long answer is below. In this article, we aim to provide you with all the information you need before you buy this ETF; everything from how VWO exactly works and how it compares to its competitors to how it may fit into your portfolio and the risks associated with it you need to be aware of.

Let’s get started…

Table of Contents

ETF Fundamentals

The Vanguard FTSE Emerging Markets ETF was created in 2005, is managed by Vanguard, and is traded on NYSE Arca under the ticker symbol “VWO”.

VWO currently has about $74.2 billion in assets under management, which makes it the largest emerging markets ETF in the world. Further, it is also the cheapest one with an expense ratio of 0.08%.

Note: The expense ratio is the management fees and other costs of a fund charged against the assets under management every year. For example, a $10,000 investment in a fund with an expense ratio of 1% will cost $100 in the first year, assuming a flat performance. However, Vanguard charges the expense ratio against dividends and capital gains distributions instead of principal.

Comparing the 0.08% expense ratio of VWO to two of its closest competitors will give you some context. Schwab Emerging Markets Equity ETF (SCHE) charges 0.11% and iShares MSCI Emerging Markets ETF (EEM) has a 0.68% expense ratio.

These may seem insignificant, but over time they add up and can greatly affect performance. So, choosing the ETF with the lowest expense ratio can be very rewarding in the long run.

Another very important metric that affects performance is the portfolio turnover rate. This is simply how much of the net assets of a fund are traded in a year. This is important as the higher it is, the higher the incurred transaction costs and the capital gains taxes and, therefore, the lower the returns.

During VWO’s most recent fiscal year, its turnover was 9%. As of 02/17/2023, SCHE (one of its competitors) had a turnover of 13%.

But let us take a look directly at the ETF’s returns now. We will examine its returns during various periods to gauge its overall performance.

Note: Throughout the years, VWO tracked different emerging markets indices and, therefore, the returns in some periods reflect those of more than one index.

Since its inception, VWO’s market price increased by an average 5.6% compound rate per year. In the same period, the tracked indices returned an average of 5.68%.

In the last decade (through 2022), the fund had an annualized return of 2.32%, while the indices increased by 2.31% annually.

In the last 5 years, the fund’s price decreased by 0.38% per year, while the corresponding index witnessed an annual decrease of 0.43% on average.

Last, in the past 3 years, VWO returned 3.14% per year and the benchmark 2.58%.

Investment Strategy

Now, it’s also important to understand the methodology of the ETF and what kind of exposure you have to the countries of associated markets and individual securities.

Since September 18, 2016, the VWO tracks the FTSE Emerging Markets All Cap China A Inclusion Index. The index aims to reflect the performance of equities in emerging markets, such as Brazil, China, South Africa, and Taiwan.

This index is market-capitalization-weighted which means that the stocks included in it are weighted based on the market value of their outstanding shares. The fund that tracks it will allocate its capital accordingly.

The idea of VWO is to give you exposure to such markets by attempting to replicate the performance of this index. Vanguard states that the fund has a high growth potential but it can be more volatile than funds that invest in developed markets.

Currently, the index is made up of about 4,284 holdings of various market capitalizations (small cap and upward), while the fund is invested in 5,609 stocks.

VWO’s portfolio has an allocation of 35.8% to China, 17% to Taiwan, and 15.9% to India. Additionally, its 3 largest holdings are Taiwan Semiconductor Manufacturing Co. Ltd. (4.78% allocation), Tencent Holdings Ltd. (3.92%), and Alibaba Group Holding Ltd. (2.77%).

Risks and Considerations

As with every kind of investment vehicle, there are risks associated with buying VWO. Below we list the risks as provided by Vanguard:

Stock Market Risk

This risk relates to the chance that equity prices in general will decrease. Like with other assets, the stock market has cycles with periods of increasing and decreasing prices.

Volatility Risk

For buy-and-hold investors, volatility does not have to equal risk. However, fund withdrawals can negatively impact performance if they are done in unfavorable market conditions. For this reason, high volatility which is associated with emerging markets can pose a risk for investors who may withdraw a portion or all of their invested funds in this VWO.

Liquidity Risk

This has to do with the chance that the trading volume of the underlying securities will drop to levels that will make it challenging to trade them at favorable prices. This risk is more pronounced in emerging markets than in developed ones.

Sector Risk

Sector risk is the possibility of a decline in the overall value of securities that belong to a particular sector. This risk can increase when the target index of VWO becomes more focused on one sector.

Country Risk

This is about the danger of political events negatively affecting the stock prices in the countries in which they occur. Examples of such events can be natural disasters, financial crises, and political upheaval.

Currency Risk

The fund invests in various countries and therefore converts its cash to the currencies with which the securities it buys are traded. For this reason, there’s a possibility of a loss in your investment in US dollars due to changes in currency exchange rates.

Now that you understand the risks, it’s time to consider how much you should allocate to emerging markets. The easy answer is 13% to 39% based on Morgan Stanley’s review of three EM allocation approaches.

In recent years, emerging markets have become more correlated to developed ones. For this reason, an allocation closer to the lower end of the range may provide you with the diversification you need. But since these markets are more volatile, the more you allocate to them, the more volatile your portfolio may become.

How to Buy in Vanguard FTSE Emerging Markets ETF (VWO) Stocks

With a solid reputation and a user-friendly interface suitable for both beginners and professional traders, eToro makes it easy to trade a wide variety of ETFs, including VWO. In this mini guide, we will outline the process of opening an account on eToro and investing in Vanguard FTSE Emerging Markets ETF (VWO).

Step 1: Open your Personal Account

To get started, you’ll need to open an account on eToro. Visit https://www.etoro.com and click on the “Join Now” or “Sign Up” button, usually located at the top right corner of the homepage. You will be redirected to the registration page, where you’ll need to provide your email address, create a username, and set a password. Alternatively, you can sign up using your Google or Facebook account. After filling out the required information, click “Sign Up” to create your account.

Step 2: Upload ID

Once your account is set up, you’ll need to verify your identity by uploading proof of ID, such as a passport or driver’s license. This is an essential step for complying with regulatory requirements and ensuring the security of your account. To upload your ID, log in to your account and navigate to the verification section.

Step 3: Make a Deposit

Before you can start trading, you’ll need to deposit funds into your eToro account. Log in and click the “Deposit Funds” button, typically found at the bottom left corner of the platform. Choose your preferred payment method and enter the amount you wish to deposit. Keep in mind that there may be minimum deposit requirements depending on your region and payment method.

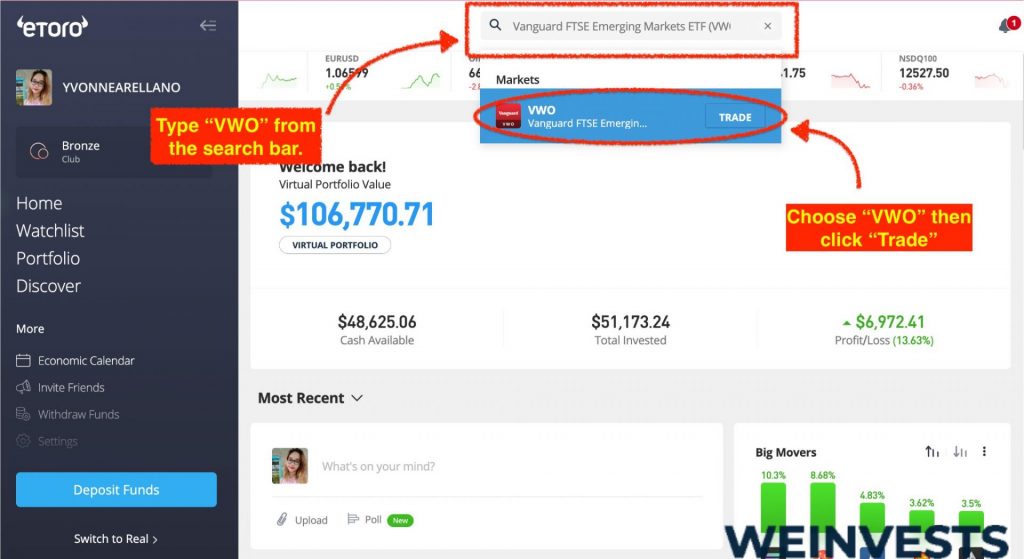

Step 4: Search for VWO

Now that your account is funded, you can search for the Vanguard FTSE Emerging Markets ETF (VWO) on the eToro platform. To do so, simply type “VWO” or “Vanguard FTSE Emerging Markets ETF” into the search bar at the top of the screen and press enter. You can also browse available ETFs by visiting the eToro Discover page: https://www.etoro.com/discover.

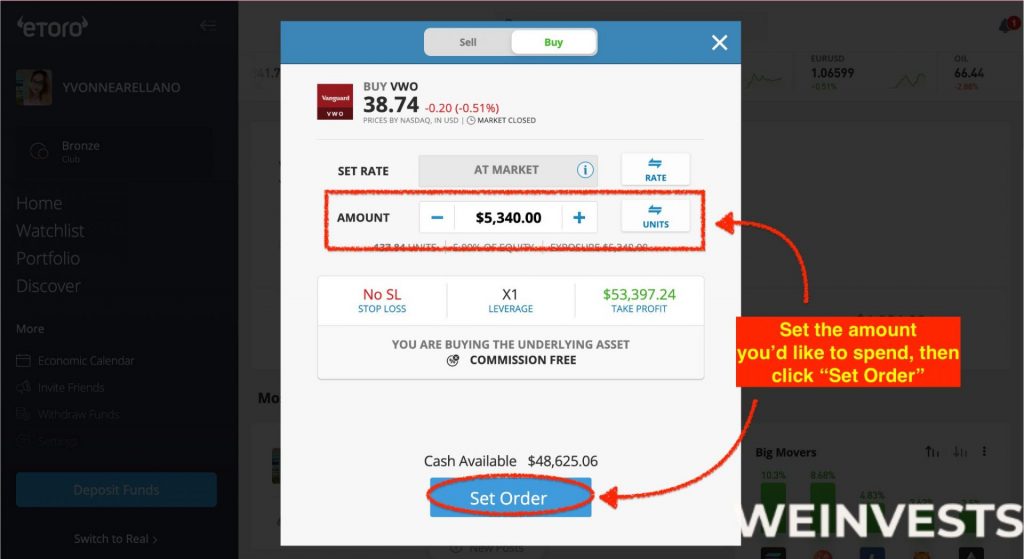

Step 5: Trade Vanguard FTSE Emerging Markets ETF (VWO)

Once you’ve located the VWO ETF, click on it to access the trading page. Here, you’ll see the current price, performance charts, and other relevant information. To buy VWO shares, click the “Trade” button, usually located at the top right corner of the platform. In the pop-up window, enter the amount you want to invest, set your stop loss and take profit levels if desired, and choose between a market or limit order. When you’re ready, click “Open Trade” to complete your investment in the Vanguard FTSE Emerging Markets ETF (VWO).

Conclusion

VWO has a low expense ratio, the history of the manager, and the fund’s assets under management make it very competitive.

Exposure to emerging markets can provide further diversification and help you get more consistent returns in the long run.

But you should be careful to not allocate a very large portion of your portfolio into it as it could greatly increase volatility. Consider consulting with a financial advisor before you buy it.

FAQs

Is VWO worth buying?

VWO is the largest and cheapest emerging markets ETF in the world. If you want exposure to emerging markets, this is a sound choice.

What index does VWO track?

VWO tracks the FTSE Emerging Markets All Cap China A Inclusion Index.

Should I invest in emerging markets?

Emerging markets provide a high growth potential and exposure to them can help diversify your portfolio. If these features sound appealing to you, then consider an ETF like VWO that invests in emerging markets.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More