This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Investing in blockchain technology can be tricky since the industry is still relatively new for beginner investors. Even professional investors are also a bit cautious when it comes to investing in blockchain technology since it entails a lot of risks. Nevertheless, with the right investment strategy, you can profit from it.

A crucial thing to keep in mind is that the companies you are looking to invest in should have a clear roadmap ahead. That way, you will know if they are worth investing in or not. One big company that many investors eye is Amazon. The company is known for its stronghold in the eCommerce field.

However, it is rapidly expanding into different areas and looking to leverage blockchain technology. The company has launched the Amazon Managed Blockchain, making headlines in the field. Amazon aims to revolutionize the tech industry and help businesses reap the amazing benefits blockchain offers.

Table of Contents

Amazon.com Statistical Overview

Amazon.com Stock Price Prediction 2023

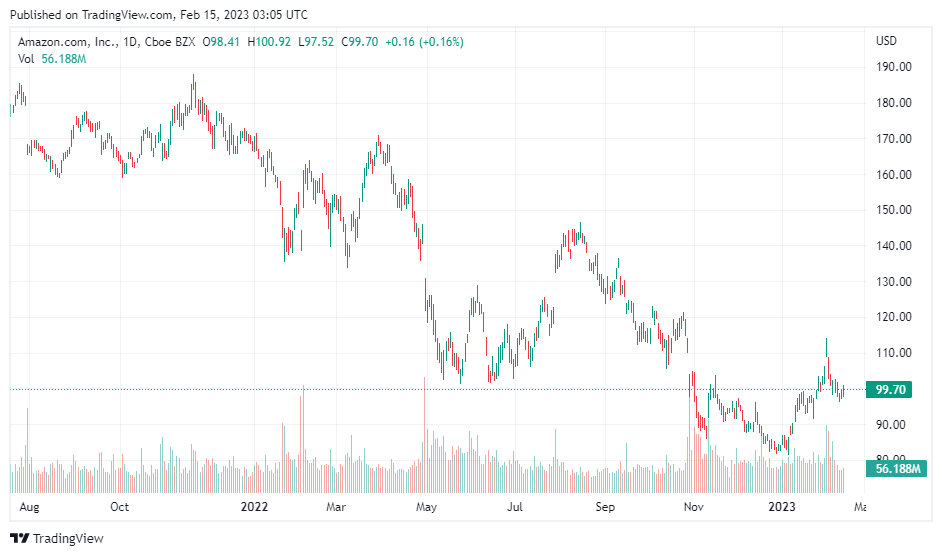

Amazon.com (AMZN) has been around for ages, but has managed to continuously innovative its way into continued relevance. From eCommerce, the company has stepped into Cloud Services, Media, Consumer Electronics, and more. 2022 hasn’t been the best for the AMZN stock, but there’s every indication that it’s a good buy option for 2023.

According to S&P Global Market Intelligence, the AMZN stock is a ‘strong buy’ for 2023. The ‘Strong buy’ rating isn’t common from the analysts at S&P index.

The expected 2023 success of AMZN is because the world’s stride in the direction of eCommerce and cloud computing is expected to continue. As of now, AWS is one of the world’s best cloud computing service provider, while amazon.com continues to power the world’s largest ecommerce ecosystem. There is also some expected revenue growth expected in the advertising arm of the enterprise.

Thanks to these, it’s expected that Amazon’s 2023 profit margin increases to 4.2% from 2.4% in 2022.

The 40% value loss of the AMZN stock in 2022 makes it very affordable for investors as 2023 draws closer. As of press time, the AMZN stock sells at $92.490. It’s predicted that the price will rise 157.498% to $238.16 over the course of next year.

Amazon.com Stock 2022

For the AMZN stock, 2022 was a long way from the all-time high ($186.57) its price achieved in July 2021. The year saw the stock price journey down from $170.40 on the 3rd of January to $92.49 as of press time. That’s about 45.30% loss. The continuous fall followed on the back of the tumultuous 2nd half of 2021.

Overall, the stock behaved opposite of what was predicted at the end of 2021, becoming more of a red zone for investors while other tech stocks enjoyed good fortune.

2022 was full of ups and downs for the American company. The year started in the red for AMZN, falling over 6% as January wrapped up. Price changes for Amazon Prime also made some headlines in February, which resulted in a slight bump for the share price. This was quickly followed by the company reporting the biggest ever one-day stock market gain of about $190 billion.

The next month saw the company have some issues with its payments partner, Visa. Then, it closed about 68 brick-and-mortar stores across the UK and US. Towards the end of first quarter, plans for Amazon to acquire MGM (movie studio) surfaced, helping the stock to some highs.

In November 2022, Amazon announced plans to let go of 10,000 workers, which expectedly negatively impacted share price. The year ended on a low, with expectations of a newly found surge in 2023.

Amazon.com Stock 2021

Overall, 2021 was a good year for Amazon as the company stock prices saw a significant rise in their value. The share price opened at $159.33 on the first day of trading in 2021 and closed at $169.67 on the 27th of December 2021. Even though the company had to deal with severe supply chain issues, it still managed to post great numbers in the third and fourth quarters.

Amazon continued to deliver its amazing services globally and became the top pick for consumers even after the restrictions due to the pandemic were lifted. Consequently, the company reported higher profits for the last two quarters of 2021.

Also, inflationary pressure was a significant problem for Amazon as the CPI (Consumer Price Index) surged to a 40-year high in the US. But that did not stop Amazon’s sales, and consumer spending remained the same, increasing its profit.

The primary development to take place in 2021 in the company’s management was Jeff Bezos’ exit as the CEO. It also impacted the share prices due to a sudden change in the company’s top leadership.

Amazon.com Stock 2020

While most companies did suffer a setback and saw a fall in their share value with gradual recovery, Amazon experienced something completely different. The company was one of the best-performing stocks in 2020, and Amazon’s share value soared by more than 75% from the height of the pandemic to the end of the year.

Amazon found itself in a great position throughout the covid-19 pandemic. As the lockdown restricted people’s movement, their reliance on eCommerce companies like Amazon increased. Thus, Amazon saw a surge in its revenues and sales. The company’s stock value increased from $94.90 from the first trading day of January to $164.29 at the end of the year.

Amazon was making staggering progress even before the pandemic and had a massive market share in the retail industry. But the pandemic helped to strengthen Amazon’s position as the market leader. Moreover, the company also started to focus on other business aspects, including blockchain technology.

Amazon.com Stock 2019

The Amazon share price started to go during the mid of 2019, and the bullish trend continued throughout the first quarter of 2020. It reported exceptional numbers in the fourth quarter of 2020 due to sales during the Christmas season.

The company’s share value significantly increased from $94.90 on the first trading day of January, and closed at $164.29 on the last day of December 2019. As the company made swift and revolutionary logistical improvements, it was able to cater to the greater demand for its services from the customers.

Therefore, the company’s sales increased significantly, and the high numbers boosted investor confidence. It saw a bearish trend by March 2020 before crashing due to the Covid-19 pandemic. In addition to its eCommerce services, the company also increased its Amazon Prime members globally, reaching 150 million. It further contributed to the increase in the company’s sales and revenue.

Amazon.com Stock 2018

The first 11 months of 2018 proved to be good for investors in Amazon shares. Its stock price climbed from $59.45 at the start of January and ended the year at $73.30 per share.

At that time, the entire stock market was facing the heat, and major tech companies were seeing a fall in their share value. Escalating the trade war with China, growing political instability, and rising interest rates were the common reasons for the Amazon share to lose its value significantly.

On the flip side, the company also had to deal with some internal issues that caused the investors to pull out their money. The company did not stand up to the expectations and predictions of the analysts regarding Amazon’s cloud computing. In addition, the fourth-quarter revenue guidance was also not very impressive.

Amazon.com Stock 2017

The year 2017 was also a great year for the company, and it enjoyed a significant increase in its share value by 56%. The stock price of Amazon.com was around $37.68 at the start of the year 2017. That stock price hit the mark of $58.47 by the last day of December, and the bullish trend continued in the first nine months of 2018.

The major driver for the increase in stock prices was the rise in sales throughout the first three quarters of 2017. Amazon earned $72 billion in 2017 compared to $64 billion from the previous year. Jeff Bezos, who was the company CEO back then, announced the following achievements that helped win the investor’s confidence:

- Announcement regarding the integration with BMW

- Enhancing Alexa’s capability to differentiate between two voices

- Integrating Alexa with Sonos speakers

- Introduction of Alexa in India

- Launch of the five new Alexa-enabled devices

- Surpassing 25,000 skills

What was the most intriguing for investors was that Amazon managed the company’s growth efficiently. That was a concern for many people since they were not sure whether Amazon could handle its rapid growth in a short span.

Amazon.com Stock 2016

Amazon’s progress over the last couple of over is stagnating. Its share price continued to increase over the last few years due to impressive sales numbers and the growing e-commerce market. In 2016, Amazon’s share value increased from $31.85 at the beginning of January to $37.49 by the last day of December.

The popularities of various tools, such as the Amazon (AMZN) Echo, helped gain the investor’s trust. Therefore, the buy call led to a bullish trend for Amazon’s stock, and it saw a massive change in less than 11 months.

Conclusion

With a global operation and a workforce of more than half a million people, Amazon dominates the eCommerce market. It is a pioneer in the eCommerce industry and is the trendsetter for delivering products to customers’ doorstep. Furthermore, the company is looking to expand its horizons and enter the blockchain sector.

The company’s prospects regarding blockchain technology present a positive outlook. It gives investors various reasons to believe that the company will continue to progress in the same way as before. Volatility is an integral part of the stock market, but researching and understanding a company’s finances helps you reap numerous benefits.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More