This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Nio has been a successful company when it comes to targeting the booming electric auto market in Europe and China. The truth is that the Chinese-based EV is responsible for some of the most dynamic changes in the market. But since COVID-19, the stock price of the Nio has had its fair share of ups and downs.

Investors have to look at Nio without bringing Tesla into the fold. Contrary to misguided perception, Nio does not manufacture its electric cars. The functional model of Nio depends on partnerships with auto manufacturers of a specific state. In China, Li Auto and Nio are close competitors of Tesla.

It is vital to understand that China is the largest RV market in the world and Nio is at the forefront to be the next leader. But in no time, many players have emerged as top-tier competitors of Tesla. In early April, Edison Yu, a Deutsche Bank analyst estimates that the stock price of Nio can come down to 65% amidst the peak-COVID-19 period.

The official word from the Nio affirms that COVID-19 managed to disrupt its growth drive and created unexpected challenges. The prediction came true and it was only a matter of time before Nio decided to shut down its EV production due to the resurgence of the pandemic crisis in China.

After March, Nio started to deliver ET7, its first original electric sedan. It is a rival of long-range model S. What’s interesting is that many Tesla holders have purchased shares of Nio. This alone sets a new precedent and hints at the long-term growth potential of the Nio.

Table of Contents

Nio Inc Statistical Overview

Nio Inc – ADR: An Overview

Nio Inc. is involved in designing, manufacturing, and development of high-end electric vehicles. In recent years, more and more people have started moving towards smart EVs to reduce their carbon footprint. But unlike other market players, Nio has managed to uniquely position itself in the European and Chinese auto industry.

The top-tier products of Nio include ES6, ES8, ET7, and EC6. At its core, Nio develops state-of-the-art and advanced battery swapping tech along with autonomous driving technologies. Nio serves as a Chinese holding company that focuses on a unique way to research, manufacture, and develop smart and premium EVs.

The electric vehicles of Nio use dedicated autonomous driving tech that involves an ultra-sensing platform and computing platform. On top of Nio Adam and Nio Aquila, the company is also involved in offering internet service for smart EVs and long-term battery warranties.

Nio offers its users express valet and home charging services. The company also provides other power-based solutions like public accessible charging, battery swapping, and mobile power charging trucks. Furthermore, Nio provides additional services like service packaging, vehicle financing, arranging battery payment, and registration of the vehicle’s license plate. Li Hong Qin and Bin Li laid the foundation of the company in November 2014. Currently, the headquarters of Nio is in Jiading, China.

Nio Stock Forecast 2023

Many analysts are predicting a fruitful 2023 for Nio because of its expansion goals, steady delivery growth, and stock price correction. Nio’s price-to-sales ratio has drastically decreased, similar to other EV stocks, making it more alluring.

The company pursues the luxury EV market niche, in contrast to some of its competitors. It is constructing its battery-swap station network and Nio houses to position itself as a long-term, major participant. By the end of 2023, Nio anticipates breaking even in its core EV business.

The business is still a long way from becoming profitable. However, Nio’s constant growth in delivery, emphasis on high-quality products, and growth plans are reasons to be optimistic about the company’s future success.

Although Nio stock may remain volatile due to industry, market, and company-specific concerns, it appears to be a good long-term investment.

Nio Stock 2022

In October of the current year, Nio’s deliveries increased significantly (+174% YoY) to 10,059 units. Deliveries for the company climbed by +32% YoY to 92,493 units in the first ten months of 2022.

While Nio’s YoY growth indicators were favourable for both October and the year as a whole, its numbers weren’t as enticing based on an analysis of MoM (Month-on-Month) trends.

Notably, compared to the company’s deliveries totalling 10,878 units in September 2022, Nio’s most recent delivery data in the previous month marked an 8% MoM reduction.

The sequential decline in Nio’s deliveries in October 2022 was mainly related to China’s COVID-zero policy and associated lockdowns.

According to CPCA data, China’s total number of new energy cars climbed by +1% MoM to 680,000 units in October of this year. Calculations show that Nio’s market share in China’s new energy vehicle market fell from 1.6% in September 2022 to 1.5% in October 2022.

Nio’s 2022 year-to-date growth stats weren’t particularly outstanding. Nio generated a +32% YoY growth in deliveries in 2022 year-to-date, as was reported earlier in this section. In contrast, deliveries for XPeng (XPEV) and Li Auto (LI) grew by +58% YoY and +54% YoY, respectively, in the first 10 months of 2022. In fact, BYD’s new energy vehicle deliveries have increased this year by +160% YoY this year.

In conclusion, NIO’s performance wasn’t as strong as the headline figures (+174% YoY growth for October deliveries) imply.

Nio Stock 2021

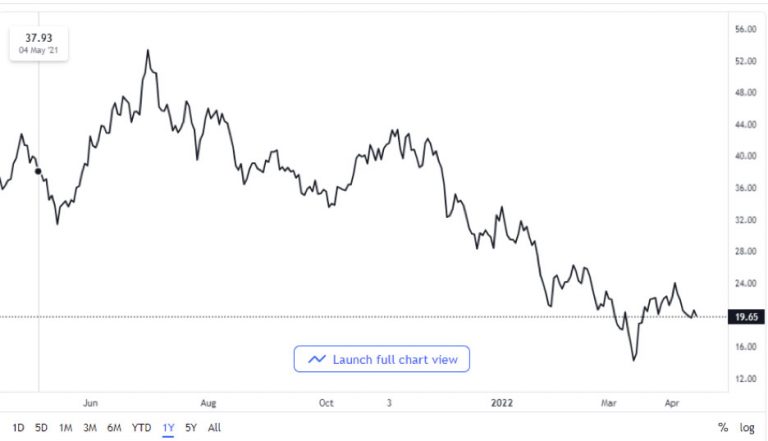

In Q4 2021, Nio published an unclear report about its long-term growth potential and COVID-19-induced losses. Technically, you can observe from the chart that the Nio stock price months of the falling streak. In fact, the stock price of Nio has lost over 50% of its value in a single year.

Our technical analysis of Nio’s stock price affirms that it would take some time before Nio can regain its original value in the stock market. From 2018 to 2019 to 2020, Nio managed to remain under the radar in terms of its stock price.

With more fear around inflation and rising interest rates, the stock price of Nio may tumble. Not to mention, Nio also experienced a shortage of major components like batteries and chips that had an impact on its stock price. Despite the pandemic crisis, Nio managed to double its EV sales in 2021. However, the close competitors of Nio managed to triple their sales and quadruple their revenue generation in 2021.

Historical Outlook of Nio Stock’s Price

From 2018 up until 2021, it would be fair to state that Nio Stock has had significant changes. But the 2020 pandemic crisis had the most significant impact on the Nio stock price. In 2018, Nio stock had the highest price on the record that managed to increase its value in a short time.

But in less than two years, the investors were trading Nio shares at a mere $5 in 2020. But in the eight months, the stock price of the Nio started to grow. In fact, Nio’s stock price grew by more than 1000% in the first eight months of 2021. And after crossing the threshold of $70 in 2021, the main challenge for Nio stock is to retain that price point in the stock market.

As of now, the Nio stock has more value than its initial public offering price. After gaining gradual market value in 2019, Nio lost over 50% of its stock price amidst a pandemic crisis. But now, Nio stock is on its way to garner over 40% of its value in stock price.

It is crucial to understand that from 2018 to 2020, Nio stock was undervalued 55%. Ironically, before the dwindling stock price of Nio, the EV leader had a whopping 117% revenue increase. Although market confidence in Nio is not completely renewed, investors believe Nio is bound to play a crucial role to advance smart EVs and increase its stock price.

Is Nio Stock Falling?

The Nio stock has lost about 40% of its value over the past month (September), significantly trailing the broader S&P 500, which has lost roughly 12% of its value during the same time frame. Several variables are driving the sell-off.

Investors continue to move away from riskier growth firms like Nio as bond yields rise and the global economy is expected to slow down.

Additionally, Nio’s Q2 results, announced in September, were a bit contradictory, with net losses increasing to RMB 2.76 billion ($411.7 million) due to higher operational costs and lower gross margins. For context, vehicle gross margins decreased to 16.7% from 20.3% in the same time last year due to supply chain issues and inflation.

Nio delivered 31,607 automobiles in Q3 (the quarter ended September), which was below expectations but within the company’s target range of 31,000–33,000 vehicles.

Further investigation reveals that Nio’s overall delivery growth rate increased by 29% year-over-year compared to Q2’s 14.4% growth. The 31,607 deliveries are much more than the company’s usual quarterly delivery of 25,000 automobiles.

Nio is putting more emphasis on the European market. It announced recently that it would begin delivering vehicles in Germany, Denmark, the Netherlands, and Sweden, in addition to Norway, where it joined the market in 2021.

Furthermore, Nio is seeking to reach the low-end market with a new sub-brand even though it has previously concentrated on the luxury EV sector with an average selling price of over $55,000 per vehicle, comparable to Tesla. This can aid the business in increasing volume.

Final Thoughts

Objectively, the financial health of Nio showed improvement signs in 2023. With a consistent increase in its stock price, the debt and liquidity rumors are also put to rest. Of course, Nio has incurred significant losses but it wants to redefine its EV position and gain significant revenue.

With new and robust electric cars, Nio wants to make the most out of the European market through battery innovations. This, in turn, would pave the way for more growth and create more EV wars. But as the post-pandemic era begins, chip supply can create a hurdle for Nio. Also, battery supplies can have a more negative impact on the stock price in the coming years.

Although there is a gradual incremental improvement in the stock price of Nio, there is also strong uncertainty attached to it. In fact, it is one of the main reasons many investors are reluctant to make long-term investments in Nio stock.

In a broad sense, the good news is that the stock price of the Nio continues to recover from its March lows. In hindsight, financial analysts and market experts want to see how the promising growth potential of Nio plays around in the next three to five years.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More