This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Porsche – one of the leading German automakers established in 1931 specializes in manufacturing and sales of high-performance sedans, sports cars, and SUVs. Although the company’s headquarter is in Germany the brand is well-known worldwide with its affiliates all around the world. The company positions itself as the one that is not afraid of the challenges such as digitisation, electronic vehicles (EVs), and ESG challenges but rather the one that sees opportunities in those fields and will use that as an advantage in further enhancing its product lines.

The company sets its goal to be the most recognised brand worldwide. We can see from the annual report that the company claims as it invests heavily in sustainability, digitisation, and innovation with a strategic target to reach 15% return on sales (ROS) and 21% of return on investment (ROI). Currently, the company employs almost 37 000 people globally.

The IPO of Porsche took place recently in September 2022 on the German Electronic Exchange (XETRA) with an initial stock price of around EUR 82 per share. As we write this the company is trading at around EUR 103.8 per share with a current market capitalization (market cap) of about EUR 93 billion making the company a large-cap stock

Table of Contents

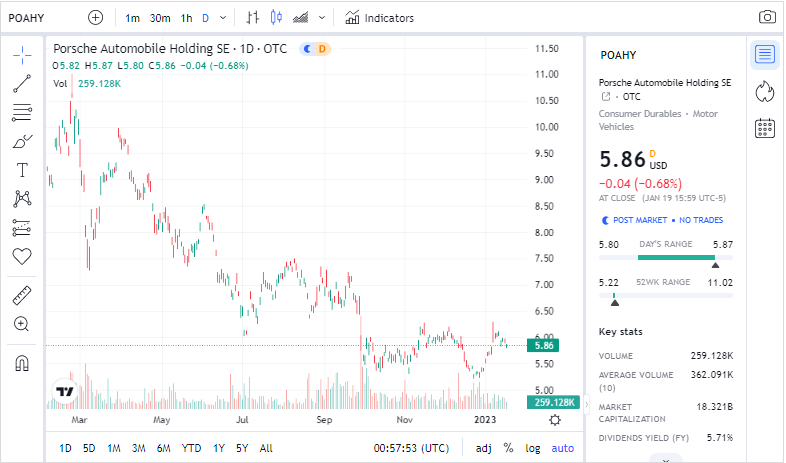

Porsche Stock (POAHY) Forecast 2023

The IPO of the company took place recently and thus there is a lack of any historical time series to analyse. This makes it difficult to predict the stock price in the future, especially when looking at the technical analysis. Nevertheless, let’s look at the fundamentals, some of the technical indicators, and what analysts predict for the future.

Starting with fundamentals we can see that the company is growing in terms of revenue and profit numbers with a year-on-year (YoY) growth of more than +15% in revenue from 2020 to 2021 and more than 27% growth in profits YoY for the same period. At the same time, the company managed to grow its total assets by about 13%, its liabilities by around 13%, and its equity by 13% YoY.

These numbers make the company have positive and stable profitability ratios such as a return on assets (ROA) of about 8% for the past two years, and a return on equity (ROE) of around 18% for the same period.

At the same time, the liquidity ratios remain at healthy levels as well since both the quick ratio and current ratio were more than 1 for the past two years. Moreover, the solvency ratios such as debt to assets are stable over the years and are at robust levels to be.

The strong financials and YoY growth especially in the COVID period speak about the company’s brand reputation that makes it immune to performing well in the midst of uncertain periods. Therefore, given the current economic and geopolitical uncertainty we can expect that the firm should be able to keep growing as it did in the previous years, at the same time supporting the growth in its stock price over the coming years.

On top of its strong financials, the company manages to innovate and invests in new technologies which speak about the ability to stay on top of the game, rather than being satisfied with the status quo.

Nevertheless, there should be some cautiousness given the recent news that the company might face supply chain issues which could strongly affect the revenue growth and profitability numbers in the future. It might be the case that the uncertainties don’t affect much the company’s performance, however, in case of such a situation where the company lacks products to be sold this would reduce the financials and thus affect the stock performance into the future. Therefore, the eyes should be on the headlines regarding the supply chain issues/fixes and if this goes well we could expect a strong performance for the company hence the stock price as well.

Although there is a very short historical time series the stock price of Porsche has been upward-sloping since September with an overall return of about 25% as we write this. Although it’s a short period to look at technical indicators they still are coming to say that the stock has space to grow when looking at indicators such as the Bollinger Bands or relative strength index (RSI). On top of those, the moving average convergence divergence (MACD) indicates that the stock price is somewhat closing its recent bearish period and is starting to revert fuelled also by somewhat positive macroeconomic data published recently.

Some analysts believe the stock will be trading in the same territory to hover between EUR 90 – 110 per share range for the rest of 2023 and early 2024. Therefore, the overall rating for the stocks is “Hold” if you own one. This is likely driven by supply chain uncertainties as the market expects to see whether this is a temporary difficulty or might become a permanent burden for the company to deliver its products on time.

Porsche (POAHY) Stock 2022

As described above the company had an IPO recently so there is not much performance to be analysed. Overall 2022 is still in the positive space with a YTD return of about 25% is what I see on my screen while writing this. The stock price has been upward sloping for most of the time since its IPO with the largest drop visible on the 11th of October 2022 due to the fact that Volkswagen sold EUR 9.1 billion worth of preferred shares of Porsche causing a decrease in the stock price but it was quickly recovered within the upcoming trading sessions.

Conclusion

Porsche’s stock price is relatively new to the market given its recent IPO, nevertheless, the stock already managed to make a relatively strong performance of about 25% increase since its inception in September 2023 compared to the overall market with the DAX index taken as a benchmark which made about 20% return for the same time period. The company has a strong brand reputation and well-established fundamentals when it comes to its income statement and balance sheet.

The firm also performed quite well in terms of revenue and profits when it comes to the COVID crisis period since these numbers kept growing. The company keeps innovating and being on top of market developments and trends which further supports the long-term price appreciation expectations.

The only concern, for the time being, is the supply chain issues and the potential shortage of Porsche’s product pipeline. This is why most of the analysts covering the stock have the stock price target in the current range of between EUR 90 – 110 per share for the next months with all eyes on the development of supply chain headlines. Nevertheless, if the company keeps innovating and remains in a robust place with its fundamentals the long-term prospects of growth of profitability and stock price are quite realistic.

FAQ

Why did Porsche’s stock price drop so much on the 11th of October 2023?

Volkswagen – another German automaker who was owning shares of Porsche sold some of its holdings in the market valued at EUR 9.1 billion which caused the stock price to drop below its IPO level. Nevertheless, the market managed to bring the stock price back to its IPO levels quite quickly and supported further growth of the price to this point where it is trading at a 25% higher level than the IPO price.

Currently, the company is facing some supply chain issues based on recent news. Most of the analysts covering the stock are waiting to see how this will develop further with the current targets being within the 10% range from the current price. This is currently one of the major threats to the company’s stock performance because apart from this there are no major concerns when it comes to the fundamentals or the firm’s ability to stay on top of the car manufacturing trends and recent developments through innovation and investments in new technologies.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More