This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

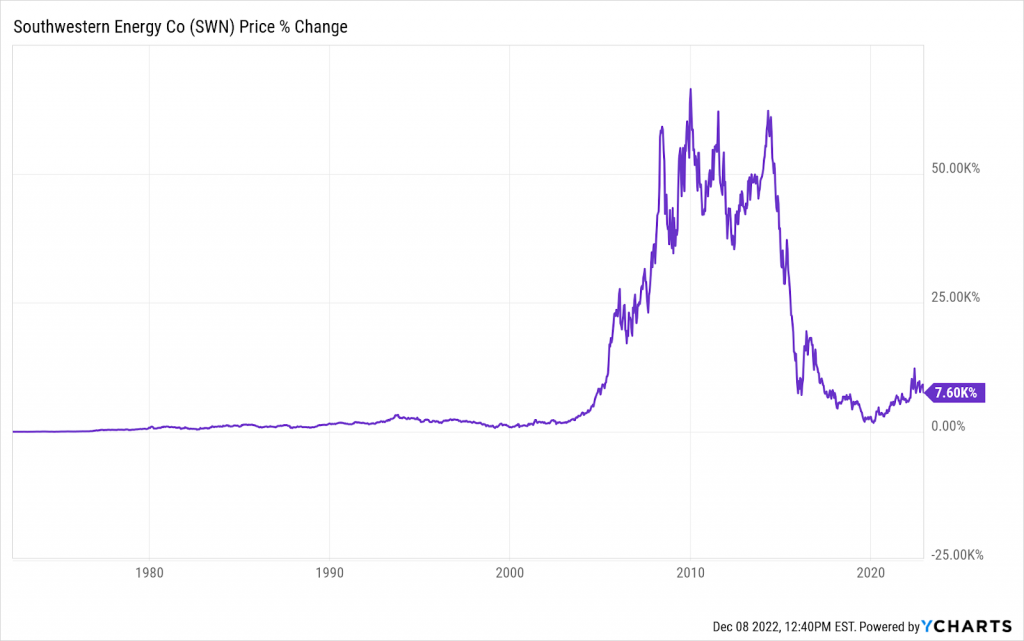

Southwestern Energy looks like an interesting stock to hold during gas price hikes, as evidenced by its past performance.

In the last couple of years, the stock has witnessed a triple-digit return. Is this trend likely to continue?

Forecasts are very bullish and the company’s past performance exhibits nothing but confidence. And its valuation is not too high relative to peers, which can be a promising sign.

However, as you will see after reading this article, this stock is not for everyone. While some investors may be able to classify its purchase as an investment, others may not be able to make it work in their favor.

In this article, we will dive into the fundamentals of the company, explain why Wall Street is likely optimistic about the stock, and examine its past price performance.

Let’s get into it…

Table of Contents

Business Overview of Southwestern

Southwestern Energy, founded in 1929 and headquartered in Spring, Texas, USA, is an independent energy company.

More specifically, the company focuses on exploration, development, and production, as well as the gathering and marketing of natural gas.

This company operates in two segments: “Exploration and Production” and “Marketing”.

Its Exploration and Production segment is the company’s primary revenue generator, including revenue derived from natural gas and liquid sales.

The Marketing segment generates revenue from the marketing of natural gas and liquids produced by the company and third parties, as well as from gathering fees associated with natural gas transportation.

It is estimated that as of December 31, 2021, it had a total of 1,527 wells on production and owned approximately 768,050 net acres in Appalachia.

Southwestern (SWN) Stock Forecast 2023

Source: CNN Business

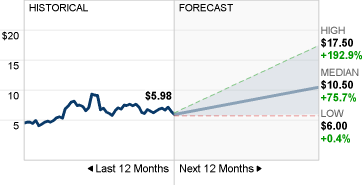

Based on Wall Street’s 12-month median price target and the stock’s price, Southwestern has a 75.73% upside. That’s a bit optimistic because it likely ignores serious risks associated with the company’s fundamentals.

Indeed, the stock has had a great run over the past couple of years. But this can be mostly attributed to an overall surge in gas prices that have benefited many peers’ stocks as well.

The company in question has no doubt more room for growth. But investors should be careful not to be seduced by the upside suggested by the consensus price target. This is not a conservative estimate, by any means.

Now, what the future will bring for the industry, in general, is very uncertain. But we can look at the present state of the company’s fundamentals and past performance to intelligently forecast a rough idea of where the stock is headed.

The first question we will answer is whether Southwestern is a stable enterprise. The current capital structure of the company is not alarming but raises flags. Its long-term debt is 3.4 times its equity and since the IPO, it has increased by 525.5%.

At the same time, we also need to challenge Southwestern’s ability to service that debt. Its interest coverage was last reported at 8.4x. This may seem high, but consider that it has decreased by 16.03% in the last 10 years.

Southwestern’s liquidity level looks even worse than its solvency level. Its current assets are only 0.3 times its current liabilities and the ratio has decreased by 65.14% in the last decade.

The performance of the business is a completely different story, though. First, its revenue grew by 375.4% over the last 10 years. For context, a direct competitor, Matador Resources, witnessed a 110.5% revenue growth. But we need to note that there are faster-growing competitors out there, such as Murphy Oil Corp growing its revenue by 1,350% over the same period.

At the same time, Southwestern grew its annual net income by 541.7% in the last decade while Matador’s net income shrank by 18.68%. All the same, Murphy Oil blew both out of the water with net income growth of 13,680% over the last 10 years.

Though the company’s growth is impressive, competition is tough. And the market seems to value Southwestern accordingly.

The stock is currently trading at 4.3 times its earnings per share, whereas Murphy and Matador are trading at 7 and 5.8 times, respectively. Southwestern’s price is also at only 0.4 times its revenue, while Murphy and Matador are trading at 1.6 and 2.3 times their sales, respectively.

However, other multiples like the enterprise value to free cash flow is higher for Southwestern (14x). Murphy Oil and Matador Resources have enterprise values that are 8.7 and 11.2 times their free cash flows, respectively.

Another contradicting indicator is Southwestern’s price relative to its book value, at 4.6 times. While a high multiple on its own for conservative investors, it looks even higher compared to the book value multiples of the company’s peers (Murphy Oil: 1.4x, Matador Resources: 2.3x).

For investors who have an already widely diversified portfolio, SWN could be a safe addition to get exposure to the gas market. However, based on its valuation and questionable solvency and liquidity, Southwestern must be classified as a speculative opportunity in isolation.

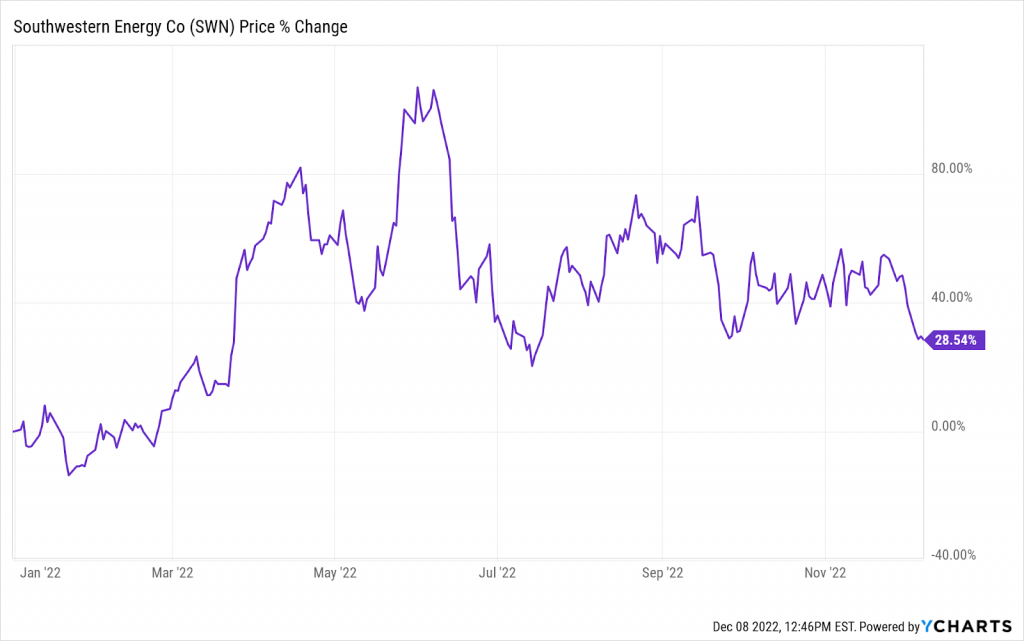

Southwestern (SWN) Stock 2022

The past year was fairly good for SWN. Its price has increased by 28.54% since the start of 2022.

The stock has apparently fared well because of overall growth in gas prices. Below, we will point to a few sharp one-day price swings that are correlated to such price increases:

- Oct. 03 (+7%)

Truist Securities upgraded shares to Buy from Hold on that day, and raised their price target to $11 from $7 on the belief that high gas prices could propel shares higher in the future.

According to Truist’s Neal Dingmann, the company’s “ample takeaway capacity, positive upcoming financials, and efficient operations” place the stock well-positioned to benefit from continued strong natural gas prices. - Aug. 22 (+8.6%)

Natural gas prices hit another 14-year high on that day, and Goldman Sachs raised its stock price target from $7.50 to $8.25.

According to Goldman, “favorable gas prices next year can further reduce balance sheet risk and enhance emerging capital returns potential,” adding that the stock would benefit over the long run from the “development of LNG markets and the potential for premium pricing.” - Aug. 11 (+8%)

Natural gas prices rose to almost $9 before closing Thursday +8.2% higher at $8.874/MMBtu (NG1:COM), the highest closing price since July 26, apparently due to talks of increased gas flows to the Freeport LNG export facility.

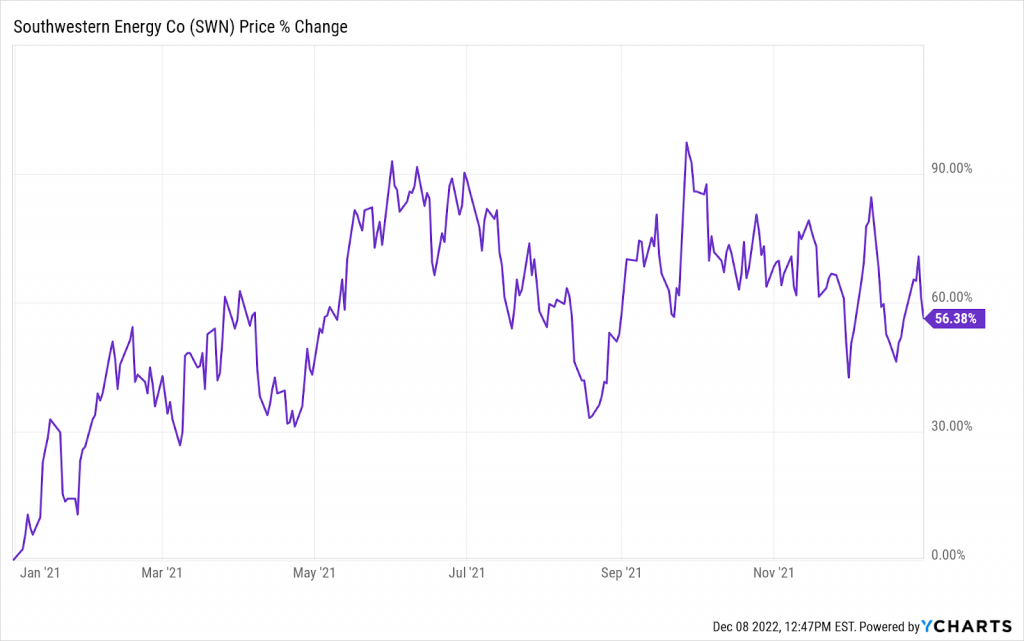

Southwestern (SWN) Stock 2021

The year 2021 was exceptionally kind to SWN. The stock closed the year 56.38% up.

Just like in 2023, you will be able to witness a correlation between the stock’s performance and gas prices.

Here are two examples to illustrate this:

- Oct. 25 (+7.4%)

The front-month price of natural gas closed at $5.898/MMBtu that day, which was 12% higher than the day before. - Sep. 27 (+22%)

Natural gas prices in the United States hit a seven-and-a-half-year high on the same day, as gas shortages sweep Europe and Asia, causing higher demand for liquefied natural gas from the United States.

Conclusion

As it’s evident, there’s no definite answer when it comes to how the stock’s price will behave in the long term, much less in the short term.

Part of the reason is the fact the SWN’s price seems very dependent on the hype surrounding the industry’s developments. Another is the company’s solvency and liquidity levels, which would make any conservative investor nervous.

But a big issue here is that relative to its past performance, the company is not trading at an attractive enough price right now. A competitor, Murphy Oil has grown at a much faster rate and there is not a very wide gap between its valuation level and that of Southwestern.

For these reasons, a distinction should be drawn between the attractiveness of the stock to well-diversified portfolios and concentrated ones. This pick may be of more utility in the context of several other selections in the industry by an investor looking for exposure to this market.

Isolated from such context, this may be a dangerous pick for concentrated portfolios that rely on each of their components to classify as investments on their own.

FAQ

Is Southwestern Energy a good stock to buy?

Southwestern Energy is not a bad bet when it comes to getting exposure to the gas market. However, investors should make sure to diversify their portfolios with other oil & gas stocks. Southwestern’s solvency and liquidity are questionable and it’s certainly not undervalued, deeming the purchase of its stock speculative by itself.

Will SWN stock go up?

SWN will go up by 76.73% according to Wall Street’s expectations. There are currently 20 analysts offering 12-month price forecasts for the stock. The median price target is $10.50, the lowest is $6, and the highest is $17.50.

Does Southwestern Energy pay dividends?

No, Southwestern Energy doesn’t pay any dividends. If you, however, intend to buy the stock when it becomes cheaper, consider selling puts with the strike price at the one you would enter a position anyway. That way, you can receive some income until you come to own the stock.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More